Mexico FinTech News

Significant potential impact from interchange fee reduction proposal

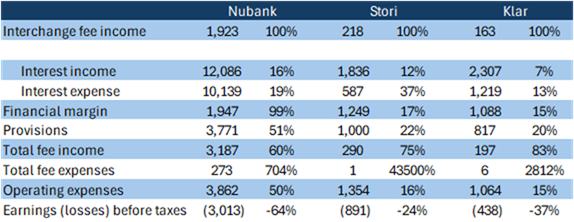

Mexico’s financial regulators have launched a public consultation on new rules for card networks and payment systems. The draft framework covers licensing requirements, network access for new entrants, data-sharing obligations, and pricing transparency for card transactions. From a short-term perspective, most relevantly the proposal calls for a cap on the interchange fee (the commission paid to the institution that issued the card being used), of 0.6% for credit cards (down from a weighted average of about 1.35% currently) and 0.3% for debt cards (down from an average of about 0.45%). So, while the proposals are meant to boost financial inclusion and competition, they may disproportionately hurt the Fintehcs that depend on interchange fees to a greater extent than many incumbent banks. For Nu, Stori and Klar, interchange fee income amounted to MXN 1,923 mn, 217 mn and 163 mn in 2024, respectively, comprising the bulk of their total fee income and a big slice of operating revenues (especially for Nu). Any potential reduction in this line item would thus hurt their operating margins in the short term, even if over the longer-term they would be expected to adjust their business model to offset this. The proposal is now up for discussion, with BBVA and Banamex as the most affected parties in absolute terms aggressively leading the lobbying against the possible move.

2024 interchange fee income, as a percentage of select income statement items

Source: Miranda Partners, Company audited financial statements. Figures in MXN mn.

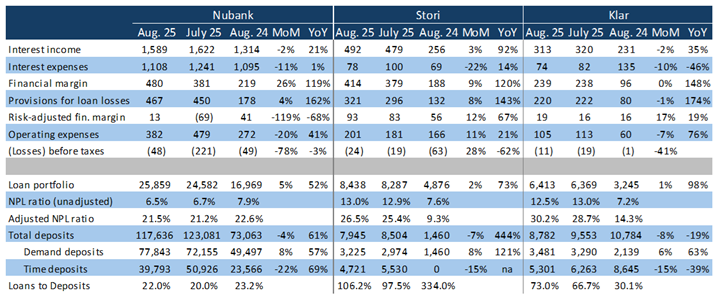

Sofipo results: lower deposits help

Nubank reported positive monthly net income in September, driven by a big increase in the financial margin, by negative taxes and a $100mn capital increase in August. Risk-adjusted financial margin was positive again. Operating results stayed in the red, albeit these losses narrowed sharply. The improvement was largely explained by deposit withdrawals (they declined by 12% QoQ), and the cut in yields on deposits, both of which substantially reduced financial expenses, but raised questions about the “stickiness” of the fintech challengers’ deposits: will their depositors, high-income and financially savvy individuals, prove less loyal than their credit card holders? Bears will say the move is not a great sign for the narrative of pursuing principality. Nu’s loan portfolio continues to grow at a healthy MoM rate of 5% and 56% YoY. Given that Nu’s deposit base exceeds its loans by about 4x, there is plenty of room to reduce deposit base, grow loans, and still maintain sufficient liquidity. As it does so, it is finally expected to achieve profitability in 2026, according to several Wall Street analysts, although will still be far off achieving a positive return on huge amount of capital invested since starting Mexico operations. Klar managed a positive operating result, and another positive adjusted net interest margin, despite continued credit quality pressure. Its MoM loan growth remains slower than Nu’s, at 2%. While profitability trends are encouraging, the company is provisioning at a slower pace (MXN 217 mn per month during 3Q) than its write-offs (estimated at MXN 233 mn) perhaps as loan growth slows down.

Source: Company data, CNBV, Miranda Partners. Figures in MXN mn. * Adjusted NPL ratios for September 2025 are estimated.

CNBV also (at last) published Sofipos’ financial results for August which in the case of Nu and Klar have been overtaken by their publication of September data mentioned above. But for those who like to keep track of such things, all three of Nubank, Stori and Klar saw meaningful sequential reductions in total deposits, with a significant mix shift from Time to Demand deposits. As for credit quality, trends remained concerning: Klar’s adjusted NPL surpassed 30%, while Nubank had a slight sequential uptick, despite strong portfolio origination. All three reported operating losses.

Source: CNBV, Miranda Partners. Figures in MXN mn.

Jack Ma’s Ant Group invests in Mexico’s R2 to expand across Latin America

Ant International, the global arm of Jack Ma’s Ant Group, bought R2, a Mexico-based embedded lending fintech that provides credit infrastructure and capital to platforms such as Rappi and InDrive. The deal, which includes a primary capital injection, aims to expand access to credit for small and medium-sized businesses (SMEs) in the region. While financial terms were not disclosed, VC funds were understood to have exited pre capital increase at a value of around $130mn, more than doubling their money in little over a year. As venture capital activity in Latin America hits a seven-year low, Ant’s move reflects growing Asian investor interest in markets with high underbanked populations and rising digital adoption. Through the partnership, Ant will equip R2 with AI-driven tools to lower credit costs and enhance its lending models, following R2’s recent launch of working capital solutions in Brazil. The deal aligns with a broader wave of Asian fintech expansion into the region, including Xendit’s entry earlier this month, while R2’s existing backers include Google’s Gradient Ventures, Y Combinator, Endeavor Catalyst, and Cometa.

El Financiero, 30/10/25, Carolina Millán and María Clara Cobo: Jack Ma’s Ant Group invests in Mexico’s R2 to expand across Latin America Other Sources: Bloomberg

Spin by Oxxo strengthens credit strategy before applying for a banking license in Mexico

FEMSA’s fintech arm, Spin by Oxxo, is prioritizing the expansion of its credit services and data-driven lending capabilities before seeking a full banking license next year. CFO Martín Arias Yániz said the company aims to gain deeper visibility into its credit performance before formally pursuing authorization, with planned investments of US$20–30 mn in new pilot programs. Spin, which added 800,000 users in Q3 to reach 15.3 million (up 22.3% year over year), now records an average of 84 million monthly transactions and 9.9 million active users. Incoming CEO José Antonio Fernández Garza Lagüera said Spin will help anchor Oxxo’s ecosystem without removing cash from its business model, emphasizing that physical transactions remain vital for Mexico’s economy. Meanwhile, FEMSA reported Q3 revenues of MXN 214.6 bn (up 9.1%) and EBITDA of MXN 30.8 bn, while net income fell 36.8% to MXN 5.8 bn due to currency losses and higher interest expenses.

Latam Fintech Hub, 28/10/25, EL CEO: Spin by Oxxo strengthens credit strategy before applying for a banking license in Mexico Other Sources: Milenio

Walmart’s fintech Cashi to enter Mexico’s remittance market as next step

Walmart de México y Centroamérica will expand its fintech arm, Cashi, into the remittance business during Q4 2025, allowing users to receive international money transfers directly into their Cashi accounts. The move follows the August launch of Cashi’s debit account, which marked Walmart’s return to financial services and positioned it to compete with neobanks like Nu, Mercado Pago, and Spin by Oxxo. CMO Javier Andrade said the initiative targets the 6 million daily customers across Walmart stores and builds on the retailer’s digital ecosystem, which includes its mobile operator Bait—now with 23.5 million active users and MXN 8 bn in revenue so far this year. Despite softer consumer demand, Walmart’s Q3 sales rose 4.9% year over year to MXN 241.5 bn, while net income fell 9.2% to MXN 11.7 bn amid currency and cost pressures. CEO Cristian Barrientos Pozo said the company remains focused on sustainable growth and market share gains despite macroeconomic uncertainty.

El CEO, 28/10/25, Roberto Noguez: Walmart’s fintech Cashi to enter Mexico’s remittance market as next growth step.

Digital payments strengthen savings culture and financial inclusion in Mexico

More than half of Mexicans now hold a formal savings account, with digital payments emerging as a key driver of financial inclusion. According to the 2024 National Financial Inclusion Survey (ENIF), 63% of the population has some form of savings product, while 33.6% does not save at all, highlighting persistent economic gaps. Payroll and pension accounts remain the most common savings tools (36.2%), followed by standard savings accounts (24%) and government aid accounts (11.6%). Non-bank apps already represent over 10% of accounts, reflecting growing digital adoption. Platforms such as SPEI, CoDi, and Dimo—operating 24/7 without fees and backed by Mexico’s central bank—are helping users manage money securely, automate deposits, and reduce reliance on cash. Although not designed specifically for saving, these systems provide essential infrastructure for formal and digital savings, particularly among unbanked populations, said Jaime Márquez Poo, executive director at fintech Sistema de Transferencias y Pagos (STP).

NotiPress, 29/10/25, Patricia Manero: Digital payments strengthen savings culture and financial inclusion in Mexico

Revolut aims to compete with major Mexican banks; targets top 5 in users within five years

Following its recent banking license approval, Revolut plans to launch operations in Mexico and directly compete with the country’s largest financial institutions. CEO Juan Miguel Guerra said the British fintech aims to be among the top five banks in Mexico by user base within five years, starting with a beta phase before a full rollout. The company expects to reach one million clients in its first year and eventually serve both retail and SME segments. Revolut will offer currency exchange, international transfers, debit accounts, and later credit cards, emphasizing efficiency and user experience. Guerra described the coming years as the “World Cup of digital banking,” where Revolut will compete against incumbents and new entrants like Nu and Mercado Pago. With 70 million users globally, Revolut sees Mexico’s large unbanked population and strong remittance corridor as key drivers for growth.

El Economista, 28/10/25, Edgar Juárez: Revolut aims to compete with major Mexican banks, targets top 5 in users within five years

Trafalgar Sofipo begins operations with CNBV approval, aiming to revolutionize SME financing in Mexico

The CNBV has officially authorized Trafalgar, the first new Sociedad Financiera Popular (Sofipo) approved by its Governing Board in over a decade, to begin operations. Led by entrepreneur Porfirio Sánchez-Talavera—who previously sold Trafalgar Digital IFPE to Walmart in 2023—the institution seeks to transform SME access to credit through AI-driven analytics and digital liquidity solutions traditionally reserved for large corporations. The firm targets Mexico’s more than 5 million SMEs, which generate 52% of GDP but face limited credit access.

El CEO, 30/10/25, Staff: Trafalgar Sofipo begins operations with CNBV approval, aiming to revolutionize SME financing in Mexico

Finia, new Mexican fintech, seeks to transform access to credit

Finia, a Mexico-based fintech founded with the mission “Intelligence that improves your finances,” officially launched as the country’s first AI-native lending platform focused on expanding credit access. The company uses advanced artificial intelligence and alternative data to evaluate clients, assign credit, and manage operations—allowing broader access to affordable loans for individuals and small businesses often excluded by traditional banks. Finia’s model offers lower rates and evolving credit terms based on responsible payment behavior. Backed by investors such as Deciens Capital, Clocktower Ventures, Precursor, Twine Ventures, Cracks Fund, and ION Financiera’s José Shabot Cherem, Finia aims to become a global leader in AI-driven lending.

Excélsior, 29/09/25, E. Cruz: Finia: the new Mexican fintech transforming access to credit

Additional reading…

- Opinion: Plata’s shock valuation

- CNBV reviewing Klar’s acquisition of Banorte’s digital bank Bineo

- Kapital secured the largest global WealthTech deal in Q3 as investments halved YoY

- Belvo and Banco Azteca transform access to credit in Mexico, surpassing 6 million income verifications

- Covalto evolves from fintech to digital bank to empower Mexico’s SMEs

- Monterrey DNA a feature of Spin by Oxxo and Ualá ABC

- Mexico’s discount weekend El Buen Fin will test the maturity of digital payments in Mexico

- Kueski and dLocal establish strategic partnership to drive growth of the “Buy Now, Pay Later” model in Mexico.

- Moonflow acquires Mexican fintech Kobro

- Belvo accelerates Banco Azteca digital origination beyond 6m verifications

LatAm FinTech News

Nubank becomes Brazil’s most valuable company

Brazilian neobank Nubank, founded by David Vélez and Cristina Junqueira, became the most valuable company in Brazil this week, surpassing Petrobras with a market capitalization of US$77.3 billion versus US$74.7 billion, according to Bloomberg. Only Mercado Libre, valued at US$115.7 billion, now ranks higher in the region. Analysts expect Nubank’s valuation to rise more than 50% in 2025, driven by rapid customer growth, strong profitability, and its U.S. banking license application. The company reported Q2 net income of US$637 million, up 43% year-over-year, with a 28% ROE. Following these results, BTG Pactual, Itaú BBA, Citi, Bradesco BBI, and Santander upgraded their outlooks on the stock, with BTG and Itaú moving it to “outperform.” Nubank will report Q3 earnings on November 13.

El Economista, 29/10/25, Staff: Nubank becomes Brazil’s most valuable company

MercadoLibre earnings miss expectations but revenue beats forecasts in Q3

MercadoLibre reported Q3 2025 net income of US$421 million, up 6% year-over-year but below analyst estimates of US$481 million, as currency headwinds and weaker demand in Argentina offset gains in Brazil and Mexico. Revenue rose 39% to US$7.4 billion, surpassing projections of US$7.2 billion, driven by a 35% increase in gross merchandise volume and stronger e-commerce and fintech activity. Lower free-shipping thresholds in Brazil boosted buyers by 34% but compressed operating margins to 9.8%, the lowest since late 2023. The fintech arm, Mercado Pago, expanded its credit portfolio 83% to US$11 billion, led by credit cards, while delinquency rates improved to 6.8%. CFO Martín de los Santos said investments in Brazil are paying off despite short-term pressure on profitability, as Mexico’s operations helped lift margins overall.

El Economista, 29/10/25, Reuters: MercadoLibre earnings miss expectations but revenue beats forecasts in Q3

Additional reading…

- Ualá lays off 135 employees in the region, most of them in Argentina

- OpenAI launches ChatGPT Go in Brazil, partners with Nubank for exclusive benefits

- Sharp drop in the crypto dollar: the new financial indicator that anticipated the government’s victory in Argentina

- Welli fintech raises $75M in structured debt

- Velotax raises $23M Series A round

- Bemobi, Brazilian payments fintech, launches “Pix orchestrator” to simplify recurring and contingency payments in Brazil

- Nequi expands operations to El Salvador and Guatemala to boost financial inclusion in Central America

Global FinTech News

PayPal signs deal with OpenAI to integrate its wallet into ChatGPT

PayPal has partnered with OpenAI to make its digital wallet the first embedded payments solution within ChatGPT, allowing users to complete purchases directly through the AI platform starting in 2026. The deal enables PayPal’s 400+ million users to buy items via a “Buy with PayPal” button while merchants can list and sell products through ChatGPT, marking a major step in AI-driven commerce. CEO Alex Chriss said the integration brings PayPal’s full ecosystem of verified merchants, payment routing, and fraud protection to the platform, ensuring secure transactions with customer safeguards such as dispute resolution and package tracking. The move positions PayPal as a core payments backbone for agentic AI shopping, following similar e-commerce integrations announced by OpenAI with Shopify, Walmart, and Etsy. PayPal will also expand the use of OpenAI’s enterprise tools internally to speed product development cycles.

CNBC, 28/10/25, Hugh Son: PayPal signs deal with OpenAI to integrate its wallet into ChatGPT

Wealthsimple raises $750m to expand its financial platform

Wealthsimple, Canada’s top fintech, secured up to US$750 million (CAD) in new equity funding, boosting its valuation to US$10 billion. The round includes a US$550 million primary and a US$200 million secondary offering co-led by Dragoneer Investment Group and GIC, alongside CPP Investments and existing investors like Power Corporation, ICONIQ, and Greylock. The company, profitable since 2024, doubled its assets under administration to US$100 billion in a year and plans to use the funds to scale its investing, spending, and credit products. CEO Michael Katchen said the raise underscores investor confidence in Wealthsimple’s role as a defining Canadian financial innovator. The firm’s new credit card waitlist topped 300,000 sign-ups in six months, and its “Wealthsimple Presents” event drew 350,000 viewers. Dragoneer’s Christian Jensen praised the company for “redefining financial services in Canada,” comparing its momentum to global category leaders.

FinTech Global, 30/10/25: Wealthsimple raises $750m to expand its financial platform

Additional reading…

- SavvyMoney raises $225m to expand AI-driven financial wellness platform

- Behavioural fintech Good With pilots AI model to identify overlooked creditworthy borrowers

- FinTech giant Tabby hits $4.5bn valuation in share sale

- Deep Dive: CB Insights’ Fintech 100 2025

- How real-world demos are reshaping FinTech adoption

- Coinbase and Tink Partner to Launch Pay by Bank Crypto Payments in Germany

- British crypto company KR1 plans LSE debut as UK warms to industry

- Mastercard poised to acquire crypto startup Zerohash for nearly $2 billion, sources say

- Western Union Announces USDPT Stablecoin on Solana and Digital Asset Network

- Zelle Goes International: Early Warning Expands $1T Payments Network with Stablecoin Initiative

Download PDF: MI-MexicoFintechChatter-110325