MARKETS

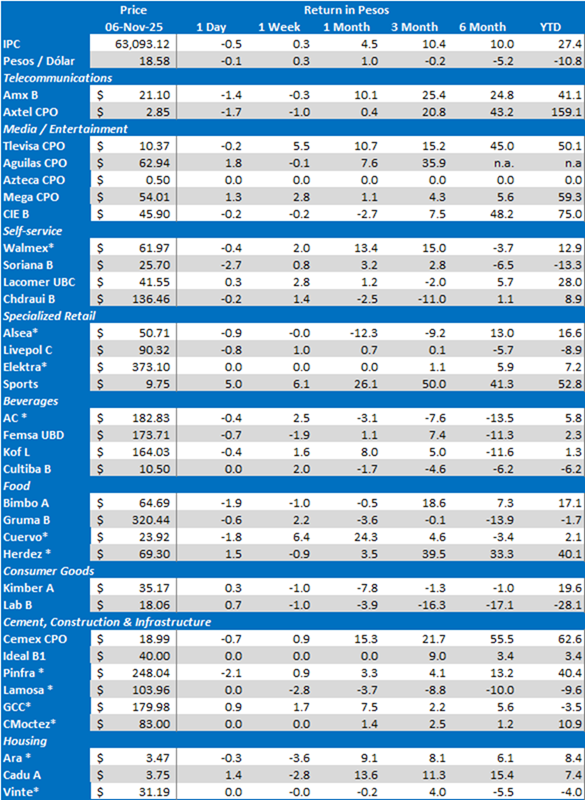

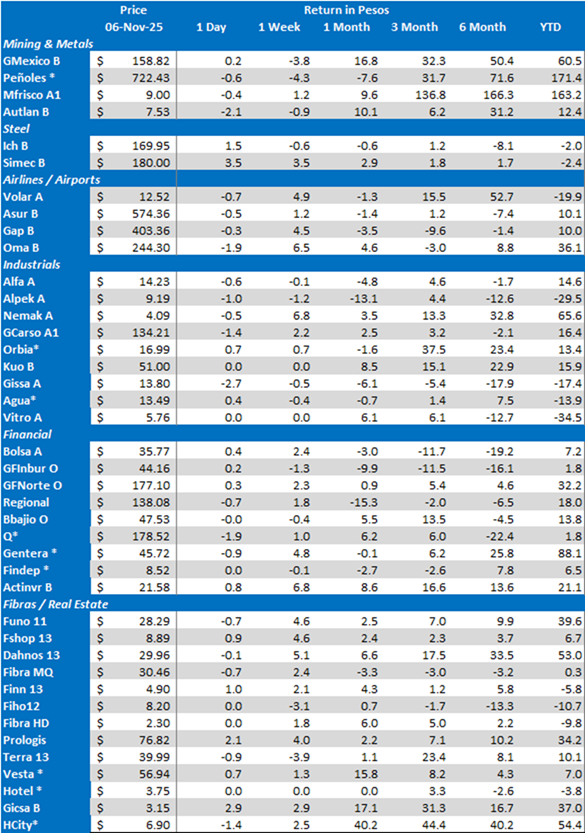

The S&P / BMV IPC advanced 0.3% over the week supported by Banco de México’s interest rate reduction, outperforming US equity indices. Meanwhile, the Mexican peso lost another 0.3% to MXN$18.58/USD; and the yield of the 10-year M-Bono was up 3 bps to 8.88%.

The S&P / BMV IPC’s top gainers were: OMA B (+6.5%), CUERVO * (+6.4%) and TLEVISA CPO (+5.5%). On the other hand, the main losers were: PEÑOLES * (-4.3%), GMEXICO B (3.8%) and FEMSA UBD (-1.9%).

LISTED COMPANIES

Grupo Bimbo appointed Alejandro Rodríguez Bas as its new CEO, in substitution of Rafael Pamias Romero. Mr. Alejandro Rodríguez was the CEO of Barcel Global. He holds a bachelor’s degree in electromechanics and industrial engineering from the Universidad Panamericana, and an MBA from Harvard. He previously worked at PepsiCo for ten years, as CEO for the Australia and New Zealand region, among other markets. He later served as CEO of Grupo LALA in Mexico, vice president at C&S Wholesale Grocers, and CEO of Acosta Sales and Marketing in the United States.

Grupo Televisa announced that, Mr. Eduardo Tricio Haro, member of the Company’s Board of Directors, has acquired shares representing approximately 7.2% of outstanding shares. Mr. Tricio also informed the company that he has no intention of achieving a significant influence” over the company.

BBVA Mexico delivered resilient 3Q25 results. Total portfolio rose 9.6% YoY, propelled by families & individuals (+11.6%) and the business book, particularly SMEs (+16.9%). The NPL ratio stayed at 1.7% and the capitalization ratio stood at 20.0%, underscoring sound asset quality and capital. Deposits grew 10.1% YoY, supporting a solid funding base, and digital activity remained a tailwind, with 3.4 billion transactions in Jan–Sep (+11.3% YoY). Net interest income increased 4.3% YoY while NIM printed 7.0% as funding costs eased and loan yields stabilized. Provisions advanced 8.6% YoY, leaving net interest income after provisions up 2.8% YoY. Total fees and commissions advanced 2.4% YoY on stronger cards and investment funds, while trading income surged 30.1% YoY on favorable rates and FX dynamics. Non-interest expense rose 3.6% YoY, with the efficiency ratio at 32.0%. Net profit edged 0.6% YoY and ROE registered 26.5%. Key developments the scheduled 4Q25 Mexico rollout of the new Futura App with the “Blue” AI assistant, and the elimination of IVR to reduce call waiting times to under one minute.

GFNorte reported weak 3Q25 results and lowered its 2025 guidance. Total portfolio rose +7% YoY, propelled by consumer +12%, commercial +9% and corporate +7%, while government fell 12% YoY. Deposits increased +3% YoY with a 69-31% demand/time mix that sustained funding efficiency. Asset quality remained solid as the NPL ratio reached 1.37% (+38 bps YoY) on an isolated Stage-3 commercial case, and cost of risk printed 2.69% (+96 bps QoQ) with coverage at 144%. Digital trends remained mixed: mobile monetary transactions advanced +30% YoY, while POS volumes declined 5% YoY with digital -23% and physical +9%. Net interest income increased 2% YoY, aided by origination and funding cost optimization, while group NIM was 6.3% (≈20 bps YoY) as bank NIM climbed to 6.9% on balance-sheet management. Provisions jumped +77% YoY reflecting the single commercial exposure. Non-interest income surged +531% YoY on stronger insurance technical results and robust trading amid FX and rates volatility. Non-interest expense rose +11% YoY, producing a 35.3% efficiency ratio, from 34.6%. Net profit fell 9% YoY and ROE settled at 20.1% (−280 bps YoY) due to a MXN$1.31 billion impairment at Bineo, plus higher reserves. Guidance was revised down to incorporate Bineo’s impairment and forgone interest from an extraordinary dividend and to widen the loan-growth range for government dynamics: loan growth 6–11% (ex-gov 9–12%), group NIM 6.2–6.5% and bank NIM 6.5–6.8%, expense growth 9.4–9.7%, efficiency 35.5–36.9%, cost of risk 1.9–2.0%, tax rate 26–28%, net income MXN$58.2–59.2 billion, ROE 22.0–23.0%.

Marc Murtra, Telefónica’s Executive Director, confirmed that the company will divest from its business in Mexico, Chile, and Venezuela as it intends to focus on Germany, Spain, the United Kingdom, and Brazil, as part of its strategic plan for the next five years. “El País” newspaper had previously reported that Telefónica might sell its Mexican operations to BeyondOne, the owner of Virgin Mobile, for around €500 million. Telefónica México reported that service revenues were up 2.7% YoY in 3Q25, supported by a 9.1% growth in the post-paid segment, while EBITDA surged 25.2% YoY.

Industrias Peñoles announced that its subsidiary Fresnillo plc (74.99% owned by Peñoles) entered into a definitive agreement to acquire 100% of Probe Gold Inc. for CAD$3.65 per share in cash, valuing the transaction at approximately CAD$780 million (US$560 million) on a fully diluted basis. The offer implies a 24% premium over Probe’s 30-day VWAP on the Toronto Stock Exchange as of October 30th, 2025. Probe owns the Novador and Detour Gold projects in Quebec, with total resources of around 10 million ounces of gold. The deal marks Fresnillo’s strategic entry into Canada, expanding its global presence and reinforcing its position among the world’s top 10 precious metal miners. The transaction, subject to shareholder and court approvals, is expected to close in 1Q26 and will be financed with Fresnillo’s existing cash.

Fibra Uno announced that, starting January 1st, 2026, the new fully internalized Funo structure will take effect. The agreements signed between the parties reflect an orderly transition under which Funo will retain ownership of the properties and the corresponding rental income through December 31st, 2025, and beginning January 1st, 2026, the transfer of properties and the termination of advisory and real estate management fees will be completed. In related news, Fibra Uno received authorization from the National Antitrust Commission to proceed with the consolidation of its industrial properties with the Fibra NEXT vehicle. A follow-on offering is under way.

Grupo Aeroportuario del Pacífico (Gap)’s Board of Directors has approved to present to its shareholders the merger of the provision of technical assistance and technology transfer services and CBX, and to internalize the technical assistance and technology transfer services, in order to simplify the corporate structure, create synergies and capture higher value for the shareholders. As a result of this business combination, Gap expects to issue and put into circulation approximately 90 million new shares. Gap expects to assume, cash and cash equivalents of US$290 million and financial debt of approximately US$74 million.

Grupo Aeroméxico announced the results of its global mixed public offering of 27,463,590 shares at a price of MXN$35.34 per share in Mexico and 11,727,325 American Depositary Shares (“ADSs”) at a price of US$19.00 per ADS in the United States. Each ADS represents 10 underlying Aeroméxico shares. Aeroméxico’s shares began trading on November 6th, 2025, on the Mexican Stock Exchange (“BMV”), and the ADSs begin trading on the New York Stock Exchange (“NYSE”) under the ticker symbol “AERO.” The Global Offering will settle and close on November 7th, 2025, subject to customary closing conditions. The Global Offering consisted of: i) a primary offering of 7,000,000 shares in Mexico and 7,394,409 ADSs in the United States; and, ii) a secondary offering of 20,463,590 shares in Mexico and 4,332,916 ADSs in the United States, carried out by certain shareholders of Aeroméxico (the “Selling Shareholders”). The Selling Shareholders have granted the underwriters of the International Offering an over-allotment option to purchase up to an additional 2,171,050 ADSs, which will remain valid for 30 days from the date of such offering. No over-allotment option was granted for the Mexican Offering. Delta, a current shareholder and Aeroméxico’s long-term strategic partner, did not participate in the Global Offering and entered into a four-year lock-up agreement. In addition to the Global Offering, Aeroméxico announced a private share placement for approximately US$25 million at a price of US$1.805 per share, to PAR Investment Partners, L.P. (the “Simultaneous Private Placement”). The Simultaneous Private Placement is expected to close on November 7, 2025, subject to customary closing conditions. Aeroméxico expects that the proceeds from the primary component of the Global Offering and from the Simultaneous Private Placement will amount to approximately US$178.8 million, before deducting underwriting discounts and commissions from the Mexican and International Offerings. Aeroméxico intends to use a portion of the net proceeds from the primary component of the Global Offering and the Simultaneous Private Placement for general corporate purposes, including payments related to fleet expansion, investments in customer experience infrastructure, and fleet maintenance obligations.

Grupo Aeroportuario del Sureste (Asur) confirmed it has submitted an offer to acquire Motiva Infraestrutura de Mobilidade S.A. (“Motiva”)’s equity stakes in the airports located in Brazil, Ecuador, Curaçao, and Costa Rica. The company has not signed any document other than the submitted offer. Asur reported that total passenger traffic increased 1.0% YoY to 5.3 million driven mainly by a 5.1% increase in Colombia, partially offset by a 0.2% redction in Mexico and a 1.7% fall in Puerto Rico.

GCC has received a favorable international arbitration award amounting to approximately US$70 million, corresponding to compensation and reimbursement of costs. The award stems from recovery actions related to the settlement agreement disclosed to investors on March 10, 2023. The arbitration process originated from the sale of shares in SOBOCE, S.A. by GCC to Consorcio Cementero del Sur, S.A. The ruling is final and not subject to appeal, and GCC will begin the necessary procedures to enforce compliance and collect payment.

Grupo Aeroportuario del Centro Norte reported that total terminal passenger traffic at its 13 airports increased 8.5% YoY in October 2025. Domestic traffic rose 8.3%, and international traffic grew 10.1%.

Volaris’ total passenger traffic increased 0.6% YoY to 2.55 million in October, with international traffic rising 3.2% and domestic traffic down 0.3%. ASM’s increased 1.1%, RSM’s fell 0.6% and the load factor declined 1.5 PP to 85.9%.

Fibra Inn has reached an agreement for the internalization of the operation of 28 of its hotels, which will take place from November 1st, 2025 to January 15th, 2026. Fibra Inn currently operates internally the Holiday Inn Monterrey Valle and Holiday Inn Puebla La Noria hotels and, in 2017, the Fibra internalized its own management.

Alsea has completed the sale of its Chili’s Grill & Bar and P.F. Changs restaurants in Chile, as well as its TGI Friday’s restaurants in Spain. This transaction is aligned with the company’s strategy to optimize its brand portfolio, with the objective of strengthening growth and improving profitability through greater operational efficiency. No amount was provided.

Coca-Cola Femsa’s series “A” shareholders have appointed Mr. José Antonio Fernández Garza Lagüera as a proprietary member of the Company’s Board of Directors, following the unfortunate passing of Mr. Ricardo Guajardo Touché, who previously held that position.

Gentera announced that Compartamos Banco, S.A., in Peru, obtained a new US$15 million credit line with Citibank del Perú S.A., and a new US$10 million credit line with Banco Internacional del Perú S.A.A. Disbursements for both credit lines are denominated in Peruvian Soles. Meanwhile, FinCrementar, S.A. de C.V. obtained an increase in its credit line with Banco Ve por Más, S.A., from MXN$150 million to MXN$250 million.

OTHER COMPANIES

Openbank, Grupo Santander’s digital bank, announced it surpassed the 500,000-client mark in Mexico as it entered its third quarter of operations, achieving deposits of MXN$10 billion (approximately US$540 million). The digital bank stated that this milestone positions it among the fastest-growing digital banking platforms in the country.

ECONOMIC

Banco de México cut its reference interest rate by 25 pbs to 7.25%, as expected by the Citi Mexico Expectations Survey. The decision was taken by majority with 4 members in favor and hawkish Deputy Governor Jonathan Heath voting to keep the interest rate unchanged. Banco de México will evaluate an additional interest rate reduction in the future, according to the press release.

Private consumption increased 0.6% MoM (seasonally adjusted) in August, rebounding from the 0.2% fall of the previous month, according to INEGI. Domestic consumption rose by 0.8% while imports were up 0.3%. Private consumption grew 0.1% YoY (original data) in August, fueled by a 0.8% rise in imports which was partially offset by a 0.3% decline in domestic consumption.

The Consumer Confidence Index (CCI) declined 0.3 points MoM to 46.1 points in October 2025, driven by weaker expectations regarding the country’s economic outlook and diminished perceived conditions for durable goods purchases, despite a modest improvement in the household’s current economic situation. The CCI fell by 3.2 points YoY, reflecting substantially lower confidence about the country’s current and expected economic situation.

Gross fixed capital investment fell 2.7% MoM (seasonally adjusted) in August, weakening against the 1.4% MoM increase of the previous month, INEGI reported. It was driven mainly by a 3.1% decrease in Machinery and Equipment and a 1.5% reduction in construction. Gross fixed capital investment fell 10.4% YoY (original data) in August, mainly as a result of 13.7% reduction in Machinery and Equipment and a 7.4% fall in construction.

Remittances declined by 2.7% YoY to US$5.2 billion in September. As a result, remittances for the January-September period were down 5.5% YoY to US$48.4 billion.

Light vehicle sales increased 6.0% YoY to 129,736 units in October, according to INEGI. Light vehicle sales rose 0.1% to 1.2 million over the January-October period.

Economists anticipate a 25-bps interest rate cut at the next Banxico meeting, according to the latest Citi Mexico Expectations Survey. The median policy rate forecast for YE25 remained unchanged at 7.00%, while the YE26 projection stayed at 6.50%. GDP growth expectations for 2025 held steady at 0.5%, but the 2026 forecast increased slightly to 1.4%, from 1.3%, in the prior survey. The headline inflation median estimate for 2025 declined to 3.8%, from 3.9%, while the core component was unchanged at 4.2%. For 2026, headline inflation rose to 3.9%, from 3.8%, and core inflation remained at 3.8%. The YE25 peso forecast strengthened marginally to MXN$18.80 per dollar, from MXN$19.00, while the YE26 projection remained unchanged at MXN$19.50.

CETES auction: 28-day CETES +20 bps to 7.30%; 91-day CETES flat at 7.23%; 175-day CETES -10 bps to 7.29% and 721-day CETES +1 bps to 7.77%.

Download PDF: MI-MxMktChatter-110725