MARKETS

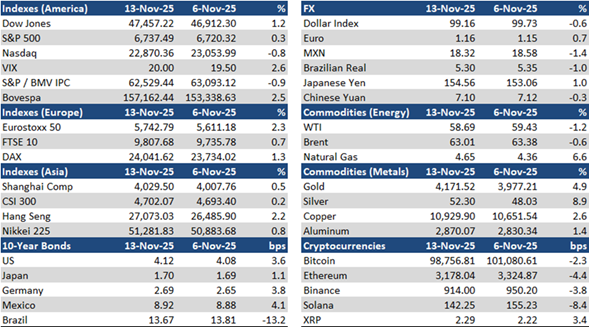

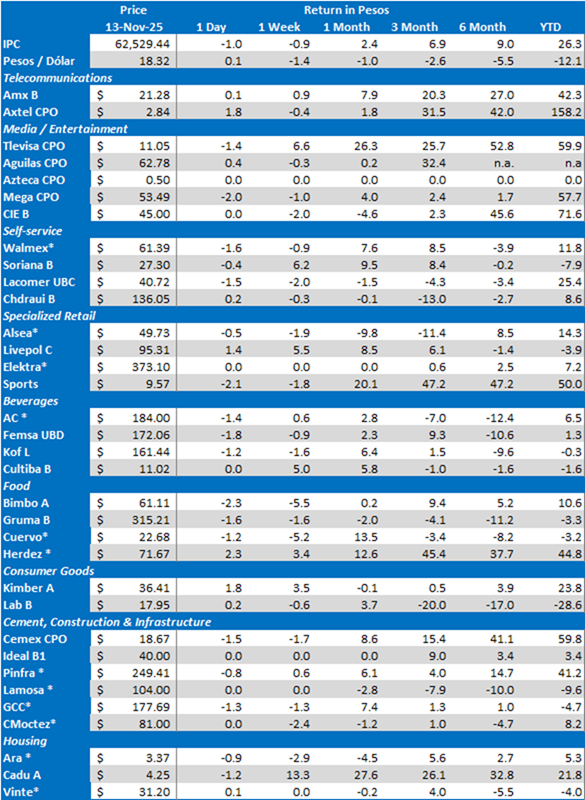

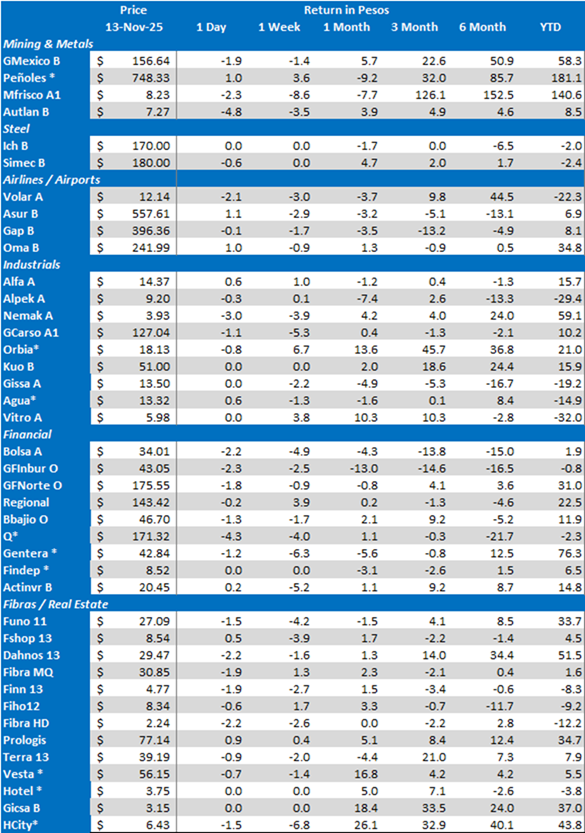

The S&P / BMV IPC saw some profit taking, retreating 0.9% after reaching historically highs, dragged down by weak domestic macroeconomic data and the correction in US technology stocks. Meanwhile, the Mexican peso appreciated 1.4% to MXN$18.32/USD; and the yield of the 10-year M-Bono was up 4 bps to 8.92%.

The S&P / BMV IPC’s top gainers were: ORBIA * (+6.7%), TLEVISA CPO (+6.6%) and LIVEPOL C (+5.5%). On the other hand, the main losers were: GENTERA * (-6.6%), BIMBO A (-5.5%) and GCARSO A1 (-5.3%).

LISTED COMPANIES

Fibra Next, sister company of Funo, announced a global follow-on of 100 million CBFIs with a 38 million CBFI’s greenshoe at a price of MXN$100.0 each, for a total amount of up to MXN$13.8 billion (around US$746 million). The offering is scheduled to take place next November 20th. The Fibra plans to use proceeds for the development and acquisition of properties.

Gas pipeline operator Esentia Energy plans to list its shares on the Mexican Stock Exchange through a US$610 million global primary and secondary IPO on November 19th, according to the preliminary prospectus. The price range is between MXN$50-71/share. The company will use 40% of proceeds from the primary portion to finance Capex, growth initiatives and general corporate purposes, while the remainder 60% will be to prepay debt.

Dodge & Cox filed in a 13-G form that it has sold most of its long-held 13.6% equity stake in Grupo Televisa. At the same time, Gamco Investors, Inc, an investment firm controlled by famous value investor Mario Gabelli, also filed it has acquired a 5.5% equity stake in the Mexican media company. This follows the October 30th announcement that Eduardo Tricio purchased a 7.2% stake.

Mercado Libre expects to generate MXN$200 billion in sales during the “Buen Fin” promotional campaign, which would represent a 14% YoY increase. The company expects an average ticket of MXN$1,000-1,500.

Quálitas expects a one-time impact of around MXN$2.0 billion related to the 2026 Revenue Law, under which insurance companies will no longer be able to credit the VAT charged by claims suppliers. Quálitas also mentioned that a transitional article was included to eliminate potential tax contingencies related to fiscal years prior to 2024, including the conclusion of any administrative or legal proceedings currently underway regarding this matter, which eliminates risks or potential impacts prior to this date.

FIBRA Prologis has received signed acceptance letters for 77,093,907 Terrafina CBFI’s, representing 9.81% of outstanding CBFI’s. Fibra Prologis will thus own 99.82% of Terrafina’s outstanding CBFI’s at the close of the offer. Settlement will take place on November 14th.

Grupo Aeroportuario del Pacífico’s total passenger traffic was down 0.8% YoY in October, with domestic traffic increasing 2.0% and international traffic declining 5.2%. Montego Bay (-17.6%) and Kingston (-13.0%) airports’ traffic was severely affected by the Melissa Huricane. However, both airports resumed operations at the end of October.

Grupo Aeroméxico obtained an injunction against the final order issued by the US Department of Transportation (“DOT”) on September 15th, 2025, which terminated antitrust immunity and withdrew the previously granted approval of the Joint Cooperation Agreement between Aeroméxico and Delta. The termination would have taken effect on January 1, 2026. On the other hand, Grupo Aeroméxico will open the Mexico City-Barcelona route in March next year with six weekly flights.

TV Azteca reached an agreement with FIFA to broadcast 32 games of the World Cup 2026. This includes all games of the Mexican national team during the group phase and knockout round.

Ollamani appointed Mr. Alexandre Costa as Chief Executive Officer of Estadio Banorte. Mr. Costa has more than twenty-eight years of experience in the administration and management of sports venues. Meanwhile, Mr. Félix Aguirre will assume the role of Deputy CEO of Estadio Banorte, overseeing the stadium’s daily operations while also serving as Host City Manager for Mexico City for the FIFA World Cup 2026™.

KOF announced the expansion of its Juntos+ omnichannel digital ecosystem. The company stated that the Juntos+ platform integrates the use of artificial intelligence to support SME’s owners and other local businesses with tools designed to optimize their operations and increase profitability. The omnichannel platform combines various tools aimed at boosting retailers’ performance. KOF’s sales force leverages data intelligence to optimize visits, fostering more effective and information-based interactions.

Alfa has called an extraordinary shareholder’s meeting for next December 8th to propose the change of its corporate name to “Sigma Foods, S.A. de C.V.”.

Banamex will start providing life annuity services through Pensiones Banamex to increase its product offering, joining Banorte, BBVA Mexico and Profuturo in that business.

Vinte has closed the acquisition of Derex Desarrollo Residencial, a housing developer that operates in the Northwestern region. No amount was provided.

OTHER COMPANIES

UK digital bank Revolut has introduced its Beta program, before launching full operations in Mexico, according to local newswires. Beta users will be able to access features such as a digital bank account with no deposit limits, the ability to buy, sell, and spend in more than 30 currencies, as well as scheduled transfers, expense tracking, and bill splitting.

Grupo Viva Aerobus’ total passenger traffic increased 6.6% YoY to 2.5 million in October, with domestic traffic up 7.1% YoY and international traffic rising 1.8%.

ECONOMIC

Mexico’s monthly headline inflation was 0.36% in October 2025, in line with the 0.36% forecast of the latest Citi Mexico Expectations Survey. Core inflation increased 0.29%, marginally above the 0.27% expectation, mainly due to higher prices in services (0.39%) and processed foods, beverages, and tobacco (0.27%). Non-core inflation advanced 0.63%, driven by a 1.89% rise in energy prices and government-authorized tariffs following the end of summer electricity subsidies, partially offset by a 0.90% decline in agricultural products. On an annual basis, headline inflation stood at 3.57% and core inflation at 4.28%, both marginally above consensus projections of 3.56% and 4.27%, respectively. They compare against September’s 3.76% and 4.28% figures, respectively.

ANTAD’s same stores sales were up 2.6% in nominal terms in October (self-service +1.6%, department +2.5% and specialized +4.6%), which was the eight month in a row with a positive performance. Total sales advanced 4.9% YoY (self-service +3.9%, department +3.7% and specialized +8.0%).

Industrial activity declined 0.4% MoM (seasonally adjusted) in September, which was the fourth month in a row with a monthly reduction, according to INEGI. It was driven mainly by a 2.5% contraction in construction activity. Industrial activity fell 2.4% YoY (original data) as a result of a 7.9% fall in construction, a 3.1% decrease in mining, and a slight 0.1% reduction in utilities.

IMSS affiliated formal jobs increased by a record high of 217,491 in October. Total IMSS affiliated workers also peaked at 22.8 million.

Light vehicle production fell 3.7% YoY to 367,870 units while exports declined 5.5% to 314,227 units in October, according to INEGI.

International visitors increased 16.0% YoY to 7.28 million in September, according to INEGI. Total expenditure rose 3.1% YoY to US$1.8 billion while average daily expenses were down 11.1% YoY to US$253.

Total credit in the banking system grew 7.1% YoY in September 2025, according to CNBV data. It was driven by solid expansions in consumer loans (+13.6%), financial entities (+11.2%), corporates (+7.4%) and mortgage credit (+5.8%), while government loans contracted 11%. Asset quality remained solid as the industry’s NPL ratio increased by 18 bps to 2.24%, and the coverage ratio declined to 147.3%, from 156.0%. System-wide net profits reached MXN$226.08 billion, up 1.6% YoY, while ROE decreased to 17.0% from 18.6% a year earlier.

Consar will lower commissions charged by Afores by 1 bps to 0.54% in 2026. On the other hand, the Commission expects Afores’ AUM’s to reach MXN$30 trillion by 2050, representing around 50% of GDP, from the current level of 23%.

With 487 votes in favor, the Chamber of Deputies approved the 2026 Expense Budget (“Ley de Egresos”). The total amount remained unchanged at MXN$10.2 trillion, up 5.9% in real terms against the previous year, after MXN$17.8 billion in reassignments.

With 467 votes in favor, the Chamber of Deputies approved an amendment to the Transparency and Regulation of Financial Services Law against unsolicited financial services.

The Government has imposed tariff ranging between 156-210% on sugar imports from WTO countries with no trade agreement with Mexico. The measure was published in the Official Gazette of the Federation (“Diario Oficial de la Federación”).

The Government expects the FIFA World Cup 2026 to generate revenues of MXN$3.0 billion with 5.5 million visitors. Hacienda recently updated the fiscal benefits for this event. It provided tax exemptions to individuals and companies directly participating in the organization, development and related activities. This excludes secondary providers and unrelated contractors.

CETES auction: 28-day CETES -25 bps to 7.05%; 91-day CETES +4 bps to 7.27%; 182-day CETES +9 bps to 7.38% and 364-day CETES +14 bps to 7.51%.

Download PDF: MI-MxMktChatter-111425