MARKETS

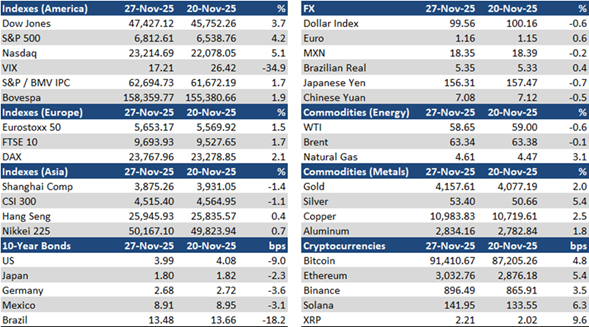

The S&P / BMV IPC advanced 1.7% over the week, fueled by the rally in US equity indices, which priced in increasingly higher odds that the FED will cut its key interest rate in the next monetary policy meeting. Meanwhile, the Mexican peso gained 0.2% to MXN$18.35/USD; and the yield of the 10-year M-Bono was down 3 bps to 8.91%.

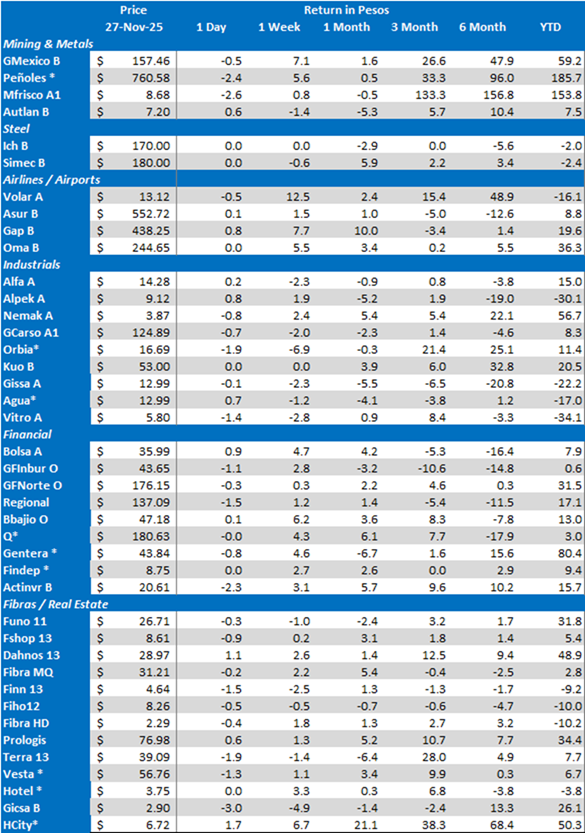

The S&P / BMV IPC’s top gainers were: GMEXICO B (+7.1%), BBAJIO O (+6.2%) and PEÑOLES * (+5.6%). On the other hand, the main losers were: ALFA A (-2.3%), KOF UBL (-1.8%) and WALMEX * (-1.7%).

LISTED COMPANIES

TelevisaUnivision announced a new multi-year agreement for distribution on YouTube TV. The expanded partnership includes distribution of TelevisaUnivision’s US networks – Univision, UNIMÁS, TUDN, and Galavisión – on YouTube TV’s Base Plan and Spanish Plan. In addition, ViX will be offered through YouTube’s Primetime Channels – and, for the first time, YouTube will extend its Primetime Channels product to Mexico. The partnership also expands TelevisaUnivision’s collaboration with YouTube through new initiatives that will bring its unique content to a broader audience.

Controladora Alpek’s and Alpek’s shareholders approved the merger of both companies with Alpek remaining as the merging entity, bringing to a near-end Alfa’s lengthy, complex but successful unlocking value strategy of removing the HoldCo and thus its valuation discount. The exchange factor will be 0.3099 Alpek shares for each share of Controladora Alpek. The detailed mechanism for the share exchange will be announced at a later date.

Grupo México Transportes (GMXT) is considering taking part in the privatization of Argentina’s Belgrano Cargas railway system, promoted by President Javier Milei, according to local newspapers. The project will require US$43 billion in investments to modernize the key network used for grain and mining transport.

Fibra Prologis placed US$500 million of 5.500% Senior Notes due 2035. Fibra Prologis intends to use proceeds for general corporate purposes, which may include repaying borrowings under a term loan, a revolving credit facility, and the repayment of maturing secured debt. FIBRA Prologis expects to list the Notes on the Singapore Exchange Securities Trading Limited (SGX-ST).

Grupo Rotoplas will propose the payment of a MXN$0.125/share cash capital reimbursement at its December 10th shareholder’s meeting. This distribution represents a 1.0% yield against the current stock price.

OTHER COMPANIES

Woodside Energy confirmed it will invest US$7.2 billion in the development of the Trion field, the first oil project in ultra deep waters, according to local newswires. Commercial production is expected to start in 2028. Regulatory slowness and uncertainty is the company’s main concern.

Mexican fintech Aviva, which offers micro-loans to underserved communities in Mexico, obtained a US$50 million credit line from Community Investment Management. The financing will help Aviva triple its size and reach an additional 500,000 clients. The credit line supplements earlier funding rounds including US$5 million from Covalto and US$1.5 million from IDB Lab. Aviva plans a Series A equity round next year and to upgrade its SOFOM license to a full banking license.

Fintech Clara obtained a US$70 million structured debt financing from BBVA Spark, Banco Covalto and the IFC. The company will use the BBVA Spark line to increase payment products in Colombia and the Covalto and IFC lines to support its expansion in Mexico.

Cryptocurrency trading platform Bitso announced that it will expand its Onchain ecosystem with a multi-platform aggregator for perpetual derivatives in the first quarter of next year, allowing users to deposit once, trade across multiple on-chain perp venues, access a unified USDC balance, receive best-execution routing, track combined PnL, and earn multiple rewards simultaneously. The company also plans to launch a Bitso Onchain token in 2026 to strengthen engagement and reward traders.

McDonald’s franchisee Arcos Dorados reached 2,500 units in Mexico after opening a new restaurant in Apodaca Nuevo León.

Canadian mining company Torex Gold Resources plans to invest US$110 million in its three Mexican complexes located in Chihuahua, Guerrero, and Sinaloa, according to local newswires.

ECONOMIC

In its quarterly inflation report, Banco de Mexico cut its 2025 GDP forecast to 0.3% (from 0.6%), with a range between 0.1-0.5%, and kept its 2026 projection at 1.1% with a range between 0.4-1.8%. Governor Victoria Rodríguez cited a contraction in economic activity in 3Q25. The Central bank also cut its 2025 inflation forecast to 3.5% (from 3.7%) and maintained its 2026 estimate at 3.0%. However, it increased its 2025 core inflation projection to 4.1% (from 3.7%) and left its 2026 estimate at 3.0%. The Board considered it appropriate to continue with the cycle of interest rate reductions.

The final reading of Mexico’s 3Q25 GDP growth remained unchanged at -0.3% QoQ based on seasonally adjusted data, after two quarters with a positive performance. However, the 3Q25 GDP annual growth based on original data was adjusted to -0.1%, from a preliminary figure of -0.2% YoY, which was the first annual decline since 1Q21.

Headline inflation rose by 0.47% in the first half of November 2025, according to INEGI. This figure was above the 0.40% forecast of the latest Citi Mexico Expectations Survey. The core index advanced by 0.04% (vs. 0.05% expected), mainly reflecting modest increases in services, whereas the non-core segment jumped 1.93%, driven notably by a 2.92% rise in energy and regulated-tariff prices. On an annual basis, the latest official data shows headline inflation at 3.61% and core at 4.32%, compared with projections of 3.63% and 4.36%, respectively.

The IGAE declined 0.6% (seasonally adjusted), below the consensus expectation of a 0.1% fall, and reversing the 0.4% MoM increase over the previous month, according to INEGI. Primary activities fell by 4.9 % MoM, secondary activities 0.4% MoM and tertiary activities 0.5% MoM. However, IGAE increased by 0.7% YoY (original data), also below the +0.8% consensus forecast, with primary activities rising 8.2% YoY, secondary activities falling 2.4% YoY and tertiary activities growing 2.0% YoY.

Mexico registered a US$606.1 million trade surplus in October, according to INEGI. Exports grew 14.2% (non-oil +16.3%; oil -29.8%) to US$66.1 billion, while imports increased 12.8% (non-oil +13.9%; oil -2.6%) to US$65.5 billion.

Service sector’s revenues rebounded 0.1% MoM (seasonally adjusted) in real terms in September, after a 0.4% MoM decline in August, INEGI reported. Service sector revenues advanced 2.2% YoY (original data).

Retail sales were flat MoM (seasonally adjusted) in real terms in September, according to INEGI. However, they increased 3.3% YoY (original data) boosted by higher sales of white goods, computers, interior decoration articles and used products.

Construction activity declined 1.5% MoM (seasonally adjusted) in real terms in September, according to INEGI. This was the third month in a row with a negative monthly figure. Construction activity contracted by 15.0% real YoY based on original data.

Mexico registered a US$2.3 billion current account surplus in 3Q25, representing 0.5% of GDP, according to Banco de Mexico. The surplus resulted from the combination of a US$8.9 billion deficit in the goods and services balance, a US$4.9 billion deficit in the primary income balance, and a US$16.1 billion surplus in the secondary income balance. The capital account posted a US$0.02 billion deficit.

Economists expect a 25-bps cut in Banxico’s December monetary policy meeting, unchanged from the prior survey, with the YE25 policy rate forecast at 7.00% and YE26 at 6.50%, both stable relative to the previous results, according to the latest Citi Mexico Expectations Survey. GDP growth projections remain steady at 0.5% for 2025 and 1.4% for 2026. Headline inflation expectations for 2025 declined slightly to 3.77%, from 3.80%, while core inflation increased to 4.23%, from 4.20%. For 2026, headline inflation rose to 3.91%, from 3.90%, and core inflation reached 3.83%, from 3.80%. The peso outlook strengthened modestly, with YE25 projected at 18.75 per dollar, versus 18.80 previously, and the YE26 projection improving to 19.31, from 19.50.

Banco de Mexico is likely to cut its key interest rate in the December monetary policy meeting and to keep such interest rate unchanged at the beginning of 2026 to evaluate the inflation behavior, according to hawkish deputy Governor Jonathan Heath. He also said that the inflation rate is unlikely to converge to the 3.0% level by 3Q25, as expected.

President Claudia Sheinbaum said in her morning conference that she will present the initiative to limit weekly working hours to 40, before the end of the current year.

CETES auction: 27-day CETES -10 bps to 7.15%; 91-day CETES flat at 7.27%; 182-day CETES +5 bps to 7.46% and 350-day CETES +12 bps to 7.63%.

Download PDF: MI-MxMktChatter-112825