Mexico FinTech News

Condusef October Loan Data: Growth Gains Momentum Across the Board

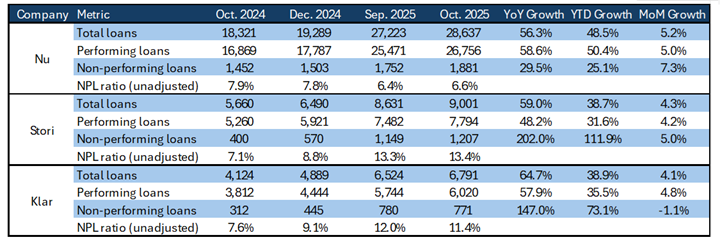

Preliminary loan data from financial consumer watchdog Condusef showed more consistent growth among the three main Sofipos in October. Stori and Klar, which averaged less than 2% MoM growth during 3Q25, saw loans accelerating at 4.2% and 4.8%, respectively, growing in October essentially the same as in all of the past quarter. For its part, Nubank continued to lead growth at 5.0%, its fourth consecutive month growing above 4%. Without write-off data, not much can be said about credit quality, other than both Nu and Stori saw (unadjusted) NPLs outpace performing loans in the month.

Source: Condusef, Miranda Partners. Figures in MXN mn.

Is Kavak now mostly a Fintech? Launches car-backed loans for general liquidity

Kavak announced a deeper pivot into fintech with Kavak Crédito, adding a general-purpose, car-backed lending line (Préstamo) alongside point-of-sale auto financing (Meses). The goal is to narrow Latin America’s auto-credit gap—where roughly two in ten consumers obtain financing versus seven in ten in the U.S.—and broaden access to mobility and credit. In Mexico, only ~37% of adults hold formal credit; Kavak says 40% of its buyers are first-time car owners. Meses finances purchases from a catalog of 6,000+ vehicles, with monthly payments starting at MXN 2,499, terms up to 72 months, and typical down payments from ~15%, via an end-to-end digital flow. Kavak reports that ~70% of applications are pre-approved and ~40% of customers have no prior credit history. Préstamo is not an auto-purchase loan: it’s a general-purpose liquidity product secured by the customer’s car. Owners can borrow up to 60% of vehicle value with terms up to 60 months, without selling the asset, to cover needs such as debt consolidation, working capital, or unexpected expenses. The application is fully online; over 1,000 customers have used it to date. By pairing point-of-sale financing with car-secured liquidity, Kavak strengthens customer retention, monetizes risk and data capabilities, and expands its addressable market beyond vehicle transactions—supporting its evolution from used-car marketplace to an integrated mobility and financial-services platform (where it now makes most of its money). The company, Mexico’s first unicorn, recently disclosed a 2025 valuation of US$2.2 billion, down the from 2021 exuberant high of nearly $9bn, but still impressive.

DPL News, 07/11/25, Raúl Parra: Kavak evolves into Fintech with new credit vertical.

Walmart and Aplazo Partner to Expand BNPL Adoption in Mexico

Walmart de México and fintech Aplazo announced a strategic alliance to integrate Aplazo’s buy now, pay later (BNPL) service into Cashi, Walmart’s digital payments app, allowing customers to shop online and pay in biweekly instalments without a credit card. The launch includes 1.5 million preapproved credit lines and targets a market where only 11% of adults hold a credit card, according to Mexico’s 2024 National Financial Inclusion Survey. Aplazo, which has raised US$100 mn in equity and US$100 mn in debt, reports that 70% of its users lack other financial products.

Milenio, 04/11/25, Fernanda Murillo: Walmart and Aplazo drive BNPL in Mexico; projected to grow 40% annually through 2032.

Remittances and Foreign Exchange Become New Growth Front for Banks and Fintechs in Mexico

Banks and fintechs in Mexico are intensifying competition around remittances and foreign exchange services, as the country remains the world’s second-largest recipient of remittances. Between January and September 2025, inflows reached US$45.7 bn, following US$64 bn in 2024, and despite a projected 3–4% decline this year, the sector remains vital to millions of families. The rise of digital transfers has pushed fintechs like Mercado Pago, Nu México, and Revolut to expand cross-border offerings through alliances with Western Union, Félix Pago, and other providers. Experts note that digital remittances now represent about 10% of total flows and could grow exponentially once they reach 12% adoption. Traditional banks, including Banorte and Santander, have responded by removing transfer fees and expanding multi-currency services via their apps, aiming to boost user loyalty and compliance under stricter anti–money laundering oversight.

Expansión, 07/11/25, Luz Elena Marcos Méndez: Remittances and foreign exchange are the new draw for banks and fintechs

Bitso Integrates USDT on Solana to Enable Faster and Cheaper Stablecoin Transfers

Mexican fintech Bitso announced the integration of Tether (USDT) on the Solana blockchain to offer faster, low-cost stablecoin transactions and expand user access to Solana’s decentralized finance ecosystem. The move allows Bitso users to send and receive USDT almost instantly and interact with DeFi platforms such as Jupiter, Raydium, and Solend. According to Bitso’s Crypto Landscape Report, stablecoins accounted for 46% of crypto purchases in Latin America during the first half of 2025, with USDT leading at 23%.

Fintech Finance News, 06/11/25: Bitso integrates USDT on Solana to enable faster and more affordable stablecoin transactions

Mundi to Allocate MXN 20 bn for Financing Mexican Export SMEs

Mexican fintech Mundi, which focuses on trade finance, launched a supplier factoring program aimed at improving liquidity for export companies and strengthening local supply chains. The initiative expects to support more than 500 exporters through an estimated MXN 20 bn in available financing, allowing them to provide credit to suppliers and free up working capital for certifications, compliance, or market expansion. The move responds to pressures from global trade disruptions and long payment terms affecting small and medium-sized exporters.

El Economista, 05/11/25, Sebastián Estrada: Fintech Mundi to allocate MXN 20 bn for financing export SMEs

Finsus and OXXO Partner to Enable Cash Withdrawals at 24,000 Stores Across Mexico

Mexican fintech Finsus announced a new partnership with OXXO and Mastercard that allows users to withdraw up to MXN $3,000 per transaction from over 24,000 OXXO locations nationwide. The service charges a MXN $20 fee (including VAT) and supports daily withdrawals up to 1,500 UDIs.

Latam Fintech Hub, 06/11/25, Finsus newsroom: Finsus and OXXO partner to facilitate cash withdrawals at over 24,000 stores in Mexico

Mercado Pago and Pro Mujer Drive Financial Digitalization for Women Entrepreneurs in Mexico

Mercado Pago and Pro Mujer launched the 2025 edition of the “Emprende Pro Mujer” program to promote financial inclusion and digitalization among women entrepreneurs in the State of Mexico, Jalisco, and Nuevo León. The initiative will support over 400 participants through six weeks of hybrid training, personalized mentorship, and seed capital grants of MXN 10,000 for standout projects. Participants will also receive Mercado Pago payment terminals to integrate digital sales tools and improve business management. Since its inception, the program has trained more than 5,400 women across Latin America—1,500 in Mexico—helping 65% increase sales and 96% adopt savings habits. The partnership underscores both organizations’ commitment to women’s economic empowerment and the expansion of inclusive financial ecosystems in the region.

Excélsior, 31/10/25, Maricruz González May: Mercado Pago and Pro Mujer promote financial digitalization for women entrepreneurs in Mexico.

Additional reading…

- Opinion: Cap on commissions: teaming up with Banxico.

- How to strengthen financial inclusion using technology and focusing on social impact.

- Stori launches debit card and cash deposits.

- Cash makes comeback in Day of the Dead weekend.

- Mexico leaves cash behind: Day to-day digital payments are gaining momentum.

- Kueski warns that fraud risks are on the rise ahead of discount weekend El Buen Fin.

- Despite complaints, BBVA app hits record new user growth in 2025 and explains its typography change.

- Banorte closes Bineo chapter after sale to Klar; prepares new AI-based app.

- Ethereum México 2025 connected government, fintech, and academia toward the next generation of applications.

- Financial culture report: Inclusion and remittances in Northeast Mexico.

LatAm FinTech News

Amazon Partners with Nubank in Brazil to Expand Credit Access and Online Shopping

Amazon and Nubank announced a partnership in Brazil that will integrate NuPay, Nubank’s online payment service, into Amazon’s website, allowing customers to access additional credit and pay for purchases in instalments of up to 24 months. The rollout will begin gradually, offering select Nubank users extra credit and, later, interest-free payments on Amazon. Executives from both companies emphasized that the collaboration combines Nubank’s digital credit capabilities with Amazon’s vast product catalog, enhancing purchasing flexibility for millions of Brazilian consumers. The partnership strengthens Nubank’s credit business while helping Amazon compete with MercadoLibre, which has recently lowered shipping thresholds and expanded promotions.

Bloomberg Línea, 05/11/25, Leda Alvim & Matheus Piovesana: Amazon partners with Nubank in Brazil to expand credit and shopping access.

CloudWalk Raises US$780 mn Through FIDC Funds

Brazilian fintech CloudWalk, operator of InfinitePay, raised US$780 mn through FIDC funds with participation from 87 institutional investors, including Itaú BBA, Bradesco BBI, UBS BB, BTG Pactual, Santander, Safra, and Banco Votorantim. The capital will finance credit card receivables for merchants using InfinitePay’s payment solutions across Brazil.

Latam List, 06/11/25, Araceli Domínguez: CloudWalk raises US$780 mn through FIDC.

Additional reading…

- Nubank to Bring Workers Back Into the Office More Days a Week.

- NuControl in Colombia and Fresh Start in Braszil; This is how Nu is innovating to improve financila inclusion.

- Itaú surges on strong quarterly results, surpasses Petrobras in market value.

- RappiPay, with no management fee, aims to double its customer base in Medellín.

- Mercado Pago launches medical service and enters the health market.

- Colombian fintech DRUO raises undisclosed seed round.

- Colombian fintech LQN raises US$12 mn for mortgage-backed loans.

- Colombia shelves digital payments tax plan after backlash.

Global FinTech News

Card Networks Close to Agreement with Merchants in the U.S.

Visa and Mastercard are nearing a settlement with merchants that aims to end a 20-year-old legal dispute by lowering fees stores pay, according to sources. Under terms being discussed, Visa and Mastercard would lower credit-card interchange fees, which are often between 2% and 2.5%, by an average of around 0.1 percentage point over several years, the sources said. They would also loosen rules that require merchants that accept one of a network’s credit cards to accept all of them. A deal could be announced soon, the people said, and would require court approval.

WSJ, 08/11/25, AnnaMaria Andriotis: Visa and Mastercard Near Deal With Merchants That Would Change Rewards Landscape

Ripple Reaches US$40 bn Valuation After US$500 mn Funding Round

U.S.-based fintech Ripple raised US$500 mn in new funding, boosting its valuation to US$40 bn as it expands beyond cross-border payments into custody, prime brokerage, and corporate treasury services. The round was led by Fortress Investment Group, Citadel Securities, Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace. The company, known for its XRP token and blockchain-based payments, has completed six acquisitions in two years and launched its own U.S. dollar–backed stablecoin, reinforcing its role in digital asset infrastructure. Ripple plans to stay private while pursuing growth through M&A and partnerships amid a more favorable U.S. crypto climate following new regulation under the GENIUS Act.

CNBC, 05/11/25, Arjun Kharpal: Fintech Ripple gets US$40 bn valuation after US$500 mn funding

Additional reading…

- How will payments change with Revolut’s 1:1 stablecoin rate?

- Santander’s Botin warns against overregulation, calls for EU innovation policies.

- Fast Growth, Fragile Foundations: How High-Growth Startups Can Build Financial Resilience.

- AI Becomes UK’s Top Financial Tool as 28 Million Adults Use Tech to Manage Money.

- This fintech unicorn just launched an AI agent to handle billions of dollars in CRE lending.

- Why Benchmark made a rare crypto bet on trading app Fomo, with $17M Series A.

- Using Premium Credit-Card Rewards Is Becoming a Part-Time Job.

Download PDF: MI-MexicoFintechChatter-111025