Mexico FinTech News

Nubank maintains strong growth in November; NPLs still deteriorate

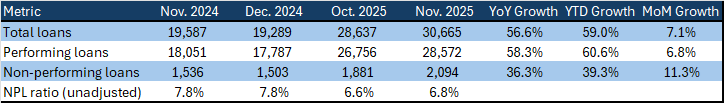

Preliminary loan data from financial consumer watchdog Condusef showed Nubank stayed on an aggressive growth mode in November, with performing loans expanding 6.8% MoM, accelerating from 5.0% in October, in its fifth consecutive month with sequential growth above 4%. Annualized growth stood at 58.3%, down marginally from 58.6% last month. On the other hand, even without write-off data it’s clear credit quality remains a concern: the NPL ratio stood at 6.8%, up from 6.6% the previous month. (Condusef’s website crashed over the weekend before we downloaded the data on Klar and Stori. “Gather ye rosebuds while ye may”, Robert Herrick would say.)

Nubank stays on aggressive growth mode

Source: Condusef, Miranda Partners. Figures in MXN mn.

Nu doubles down on the local market with US$2.5 bn investment through 2030

Nu México plans to invest US$2.5 bn over the rest of the decade as it transitions into a full-service bank under new CEO Armando Herrera, aiming to become the country’s largest digital financial institution. The strategy builds on the company’s recent expansion: the aggressive portfolio expansion explained above, 13.1 mn users, strong adoption outside major cities, and a track record of onboarding first-time credit-card holders. The investments will focus on technology, talent, and scaling operations as competition has intensified. Herrera framed rising rivalry as healthy, arguing that both digital natives and incumbent banks moving online validate the model and push innovation. (We’d further point out that the recent easing of the deposits war of earlier this year is yet another sign that competition has become more rational, eschewing the old growth-at-all-costs mentality.) If Nu maintains current momentum, cumulative investment could reach US$3.9 bn by 2030.

Reporte Índigo, 05/12/25, Gabriel Nava: Nu México doubles down on the national market and will invest US$2.5 bn over the rest of the decade.

Oxxo’s Spin plans to launch credit cards

Spin, FEMSA’s fintech arm, plans to add credit cards to its offering as part of an eight-year strategic renewal with Visa, though no launch date has been set. The product would expand a credit line introduced in June with microloans and personal loans aimed at underserved consumers, a segment showing strong demand but requiring careful risk assessment and financial education. Spin, which closed Q3 2025 with 9.9 mn active users, leverages Oxxo’s 24,000-store network as its main distribution channel. The company has also postponed until at least 2026 a decision on whether to request a banking license, which could provide deposit insurance, lower funding costs, and enable payroll and savings products once its credit business reaches scale – though also much higher operating and compliance costs.

Bloomberg Línea, 04/12/25, Italia López: Oxxo’s Spin plans to launch credit cards.

Revolut targets Mexico’s remittance market with multidimensional banking launch

Revolut, now operating as a fully licensed bank in Mexico, has launched its beta phase with a multi-currency account enabling free, instant global transfers as it seeks to capture part of the US$60 bn remittance corridor from the U.S. to Mexico. CEO Juan Guerra noted that eliminating what he calls the roughly 5% average remittance cost (that seems high to us) could return up to US$3 bn per year to Mexican households. The bank aims to reach 5.5 mn users within five years, backed by IPAB deposit insurance. Revolut’s app-only model, multicurrency card, and global payments offering position it among Mexico’s emerging neobanks competing for digital banking and remittance flows. It remains to be seen what is Revolut’s Mexico credit offering will be, key to profitability in Mexico’s market but not Revolut’s known competence. With 65 mn users worldwide and a valuation above US$75 bn, the company plans for alliances with cash operators, seeking nationwide reach as it adapts its European model to Mexico’s fast-growing, and much more credit-centric, digital financial ecosystem.

El País, 02/12/25, Karina Suárez: Revolut targets Mexico’s remittance market.

J.P. Morgan Payments drives digital-payments transformation and treasury modernization in Mexico

J.P. Morgan Payments is strengthening its role in Mexico’s evolving payments ecosystem by pairing global-scale infrastructure with locally tailored solutions that enhance liquidity management, automation, security, and multibank integration. The firm sees rising demand from corporates for real-time visibility, ERP-connected payment flows, and advanced tools that support forecasting, compliance, and operational resilience.

El Financiero, 03/12/25, Staff: Digital payments and financial transformation in Mexico: J.P. Morgan Payments at the forefront of innovation

Bitso debuts global equities with redesigned app to broaden investment access

Bitso is expanding beyond crypto with the launch of global equities, letting Mexican users buy and sell fractional shares and ETFs from more than 5,000 companies starting at MXN $20, available 24/7 and with no commissions. The rollout follows the firm’s October rebrand and a full app redesign aimed at simplifying the investment journey as formal investing remains low in Mexico, where only 5–10% of working adults invest through regulated channels. The product also reflects rising demand for hybrid fintech models that combine digital simplicity with broader asset classes.

Forbes, 02/12/25, Staff : With a new image, Bitso launches global equities product.

Additional reading…

- Banks had more changes in 2025 than they would have liked: Emilio Romano.

- Fintechs put pressure on banks.

- Banorte incorporates Oxxo as a banking correspondent.

- InDrive bets on SuperApp.

- Walmart wants to be the “one-stop checkout” for financial services.

- 2026: The Year in Which Mexico Must Bet on Financial Health.

- Listen: From banks to phones: Fintech’s revolution.

- Monato wants to revolutionize Mexico with embedded finance.

- Kueski reveals how payment habits are changing in Mexico.

- Smart Fit taps Belvo to automate recurring payments for over 1 million users in Mexico.

LatAm FinTech News

Nubank moves to obtain a Brazil banking license following a tighter regulatory perimeter

Nubank will seek a full banking license in Brazil in 2026 after regulators approved a rule prohibiting non-bank institutions from using the terms “bank” or “banco” in branding, internet domains, and public communications. The decision forces roughly 15–20 firms to adapt within 120 days, with final implementation due within a year. For Nubank, this formal shift aligns with its scale and longstanding use of “bank” in its brand, and the company says requirements will not materially affect its capital or liquidity profile. Executives emphasized that the visual identity and user experience will remain intact and that obtaining the license reinforces transparency amid heightened scrutiny following cases like Banco Master. The move also fits Nubank’s broader regulatory strategy: it already holds a banking license in Mexico, has applied for one in the U.S., and sees the Brazilian upgrade as key to maintaining trust and strengthening oversight as digital players become central to Latin America’s financial system. Meanwhile Nu is in talks to buy 10 year naming rights of the new Inter Miami football stadium for $190mn.

Bloomberg, 03/12/25, Matheus Piovesana: Nubank to seek Brazil banking license in response to rule change Other sources: Bloomberg Línea. | Nubank moves forward with naming rights for the stadium Messi will inaugurate in 2026.

Visma has purchased Chilean proptech Comunidad Feliz

Norwegian software group Visma has purchased Chilean proptech Comunidad Feliz for roughly US$70 million, about 6x revenue. The platform has become one of Chile’s leading SaaS tools for managing buildings and condominiums, handling payments, admin workflows, and transparency for thousands of communities. The deal fits Visma’s playbook in Latin America: acquire locally compliant workflow software. Over the past few years Visma has quietly built one of the region’s strongest operational stacks: Chile: Laudus (ERP), Talana (HR/payroll), Rindegastos (expenses), now Comunidad Feliz (proptech). Argentina: Calipso, Contagram, Xubio (mid-market + SMB ERP). Peru: Mandü (employee engagement). Mexico: Lara AI (HR automation). In Brazil Visma acquired Conta Azul (~US$300M), unlocking the largest SME software economy in Latin America.

DF, 05/12/25, Juan Pablo Silva: Visma acquires Comunidad Feliz for about US$70 mn.

Additional reading…

- Creditas raises $108M Series G led by Andbank.

- Argentine fintech Belo begins expansion in Brazil with the launch of its crypto-asset transaction wallet.

- Chilean fintech Xepelin has raised over US$300 mn to finance SMEs in Latin America.

- Vambe raises $14M Series A.

- BHub raises $10M to bring AI to Brazil’s accounting market.

Global FinTech News

Wealthfront targets US$2.05 bn valuation in latest U.S. fintech IPO

Wealthfront has filed for a US IPO aiming to raise US$485 mn at a valuation of US$2.05 bn, marking another major wealth-tech debut in a volatile year for listings. The digital wealth manager plans to sell 34.6 mn shares at US$12–14 on Nasdaq under “WLTH,” following years of growth and a profitable 2025, with US$123 mn in net income and US$339 mn in revenue. Wealthfront, which nearly sold to UBS in 2022, has raised US$274 mn from top-tier investors and positions itself within a broader wave of fintech IPOs—including Circle, Chime, Klarna, and Navan—whose post-listing performance has varied sharply. The offering will test investor appetite for scaled, software-first wealth platforms as public markets recalibrate expectations for fintech valuations.

Crunchbase News, 02/12/25, Mary Ann Azevedo: Wealthfront targets US$2.05B valuation in latest fintech IPO.

Bank of America expands crypto access for wealth-management clients

Bank of America will allow advisers across Merrill, Merrill Edge and its Private Bank to recommend crypto ETP allocations starting January 5, marking a shift from merely executing client orders to actively advising on digital-asset exposure. The change removes previous asset-threshold requirements and reflects growing institutional adoption amid a more favorable U.S. regulatory stance under President Trump. The bank notes that investors comfortable with volatility could consider a 1%–4% allocation, highlighting the role of ETFs and ETPs as a more liquid, secure and compliant entry point than holding underlying tokens.

Reuters, 04/12/25, Staff: Bank of America expands crypto access for wealth management clients.

Additional reading…

- Kalshi Secures $1B To Expand Predictions Market Platform.

- Stripe to acquire billing platform Metronome.

- Italy launches ‘in-depth’ review of cryptocurrency risks.

- Britain unveils fast-track licensing to boost fintech growth.

- Flex raises $60m Series B to scale AI private bank.

- Fed’s Bowman Says Regulators Working on Stablecoin Rules.

Download PDF: MI-MexicoFintechChatter -120825