MARKETS

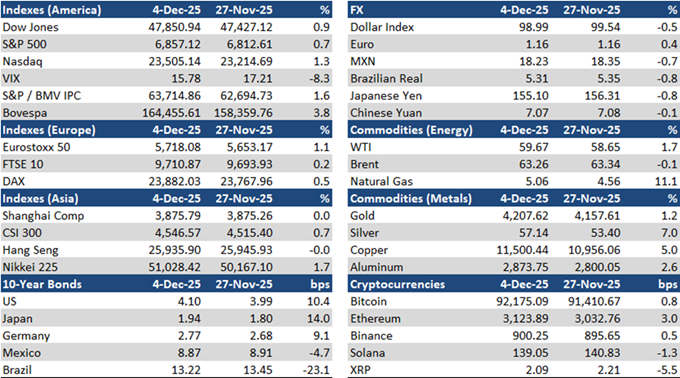

The S&P / BMV IPC maintained a positive trend, rising +1.6% over the week, outperforming its US counterparts, as global equity markets continued to price in a reduction in the FED’s interest rates. Meanwhile, the Mexican peso appreciated 0.7% to MXN$18.23/USD; and the yield of the 10-year M-Bono was down 4 bps to 8.87%.

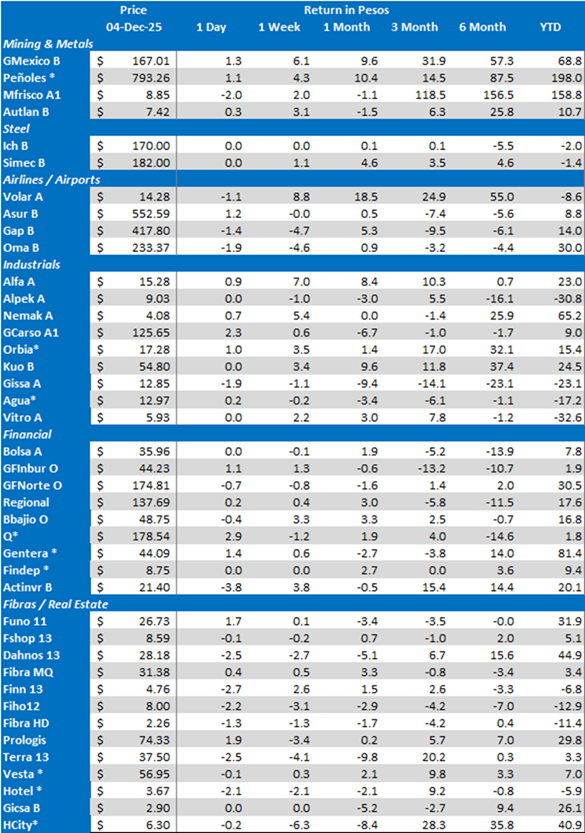

The S&P / BMV IPC’s top gainers were: GCC * (+8.6%), FEMSA UBD (+7.8%) and ALFA A (+7.0%). On the other hand, the main losers were: GAP B (-4.7%), OMA B (-4.6%) and AMX B (-4.3%).

LISTED COMPANIES

América Móvil has terminated the non-binding agreement with Entel through which the companies were considering submitting a joint bid for the acquisition of certain assets and businesses related to the operations of Telefónica in Chile. AMX will explore its potential individual participation in the sale process.

Mercado Libre has issued US$750 million in Senior Unsecured Notes due 2033. The company will use proceeds for general corporate purposes, and will further strengthen the company’s liquidity.

Grupo Aeroportuario del Centro Norte plans to invest up to MXN$16 billion over the 2026–2030 period, according to its Master Development Plan (PMD), according to local newswires. Most of the investment will be allocated at the Monterrey Airport, given that this terminal accounts for nearly half of OMA’s passenger traffic. Investments will focus primarily on runways, terminal works, aprons, taxiways, and technology aimed at digitizing information processes.

Grupo Nacional Provincial sees a non-recurring MXN$5.5 billion impact from the VAT recognition of claims providers from January 1st, 2025, which was included in the 2026 Income Law. GNP said that its solid capital base and solvency indexes, which are substantially above regulatory limits, will allow it to absorb the impact.

Femsa entered into an accelerated share repurchase agreement (ASR) with a US financial institution. Through this agreement, Femsa will repurchase US$260 million of its ADS. The company received an initial 540,035 ADS on December 3rd, 2025. The final number of shares repurchased will depend on the volume-weighted average price of FEMSA’s ADS during the term of the agreement, minus a discount. The ASR is expected to be fully settled no later than the first quarter of 2026.

Alpek announced that the merger with Controladora Alpek will conclude on December 9th through the share swap with a ratio of 0.3099 Alpek shares for each Controladora Alpek share. The listing of Controladora Alpek on the Mexican Stock Exchange will be cancelled that day.

Esentia plans to increase its transport capacity by 50% by 2030 as part of its medium- and long-term expansion strategy, according to its CEO, Daniel Horacio Bustos. The growth would come from both the supply network serving the state-owned Federal Electricity Commission (CFE) and the network supplying private clients, the latter of which would quadruple. The plan includes the previously announced 660 million cubic feet per day of additional capacity, which will require an investment of approximately US$680 million. The expansion, structured in three phases, aims to capitalize on rising demand driven by industrial growth and the relocation of investment to central and western Mexico, through the expansion and construction of compression stations and limited looping.

Volaris announced the successful completion of all inspections and repairs required under the Airworthiness directive issued last Friday by the European Union Aviation Safety Agency (EASA) on official notification from Airbus affecting approximately 6,000 A320-family aircraft worldwide. The directive addressed a flight-control software issue potentially influenced by solar flares, and in some cases required associated hardware checks. Volaris completed the full scope of work across its fleet without a single flight cancellation and with only minimal delays, ensuring passengers remained largely unaffected throughout the process. In related news, Volaris has requested government authorization to carry out the temporary leasing of seven aircraft under a wet-lease arrangement (which, controversially, come with their own foreign crew), with the aim of ensuring scheduled travel for the December season. Volaris also reported that total traffic was up 5.0% YoY to 2.68 million in November, with domestic traffic rising 3.3% and international traffic increasing 9.7%. RPM’s advanced 3.9% as ASM’s were 5.8% higher and the load factor fell 2.5 PP to 85.3%.

Grupo Herdez’ shareholders approved the previously announced sale of a 25% equity stake in McCormick de México for US$750 million.

Corporación Inmobiliaria Vesta has signed 3 new leasing contracts for more than 550 thousand square feet. This included two new contracts in the Tijuana Vesta Park Mega Region for 473.6 thousand square feet with a client of the electronics industry, and another contract for a BTS with 81.6 thousand square feet in Querétaro with a client of the aerospace industry.

Grupo Aeroportuario del Pacífico reported a 2.0% YoY reduction in total traffic to 5.13 million in November, mainly as a result of a 10.8% reduction in international traffic which was partially offset by a 4.8% increase in domestic traffic.

Fibra Mty has successfully completed the sale of the industrial property known as “Catacha”, located in Santa Catarina, Nuevo Leon, for a total consideration of MXN$70.0 million, plus the corresponding VAT on the building. This transaction is part of Fibra Mty’s ongoing strategy to optimize its property portfolio.

Fibra Inn announced that one of its hotels located in the city of Guadalajara will become the “Courtyard by Marriott Guadalajara Andares.” The property will open and initiate operations under this new identity as of December 1, 2025.

Grupo Aeromexico has strengthened its alliance with Scandinavian Airlines through the launching of a share-code agreement, effective December 1st.

Grupo Lacomer opened a new 9,249 M2 store in Tulum, Quintana Roo, through a MXN$1.1 billion investment. The company now has 91 units located in 16 states.

Grupo Sports World has obtained a 5-year MXN$400 million simple credit line with an interest rate of 28-day TIIEFC + 295 bps. The company will use proceeds to refinance existing debt, which will improve its maturity profile.

Fibra Shop raised MXN$1.25 billion with the re-opening of its FSHOP 25U domestic bond (“Certificados Bursátiles”). Such bonds have a 5-year maturity and a fixed 7.61% interest rate. The Fibra has refinanced more than 85% of its debt considering this transaction and last year’s La Perla credit.

Vinte’s Board of Directors appointed René Martínez Martínez, CEO of its subsidiary Servicios Corporativos Javer since 2017, as its new CEO effective January 1st, 2026. He will replace René Jaime Mungaro, who served as Vinte’s CEO since 2020. Both will remain as Board Directors and Mr. Jaime Mungaro will be part of the executive committee.

Fibra Next’s subsidiary Next Properties concluded its debt exchange offer of international debt instruments on December 3rd, issuing US$1.88 billion in long-term Senior Notes.

OTHER COMPANIES

Banco Sabadell México appointed José Iragorri as its new CEO, replacing Albert Figueras, who was appointed Head of Retail Banking in Spain. Mr. Iragorri had been serving as Managing Director of Corporate & Investment Banking (CIB) at Sabadell México. Meanwhile, investor David Martínez resigned as Board Director following the failed takeover by BBVA.

Chile’s LarrainVial appointed Raúl Morales Bernal as Mexico’s country head, in substitution of Carlo Lombardo. The company said that this appointment is part of its expansion and consolidation strategy in Mexico. Mr. Morales previously worked at Credit Suisse, Barclays, Merrill Lynch and NSC Asesores.

ECONOMIC

The government reached an agreement with the business sector and labor unions to increase the general minimum wage by 13% next January 1st, 2026. As a result, the minimum wage will increase from MXN$278.80 to MXN$315.04 per day in most of the country. In the Free Zone of border regions, the minimum wage will rise by 5%, from MXN$419.88 to MXN$440.87.

Remittances declined 1.5% YoY to US$5.6 billion, according to Banco de México. This was the seven month in a row with an annual contraction. Cumulative remittances for the first 10 months of the year fell 5.1% to US$51.4 billion.

Private consumption was flat MoM (seasonally adjusted) in September, after a 0.9% monthly rise in the previous month, according to INEGI. Demand for both domestic and imported goods remained unchanged. However, private consumption increased by 3.6% YoY (original data) with domestic goods rising 1.6% and imported goods jumping 14.8%.

The Business Confidence Index fell 0.2 pts MoM and 3.2 pts YoY to 48.3 in November, according to INEGI. This was the ninth month in a row with a reading below 50 points.

Gross capital formation was down 0.3% MoM (seasonally adjusted) in September, accumulating two months in the red, according to INEGI. Construction activity fell 2.6% (original data) while machinery and equipment rose 1.9%. Gross capital formation declined 6.7% YoY (original data) with construction falling 10.6% and machinery and equipment down 2.4%.

Unemployment stood at 2.6% in October 2025, INEGI reported. This figure was slightly higher than the previous year’s 2.5% level but below the 2.8% consensus forecast.

Light vehicle sales decreased 0.3% YoY to 148,359 units in November, INEGI reported. As a result, cumulative light vehicle sales for the January-November period grew 1.0% to 1.37 million units.

Banco de México’s international reserves reached a new historically high of US$250.2 billion as of November 28th, 2025.

Commercial banks’ lending to the private sector increased 7.9% YoY in real terms, according to Banco de Mexico. They were driven mainly by consumer loans (+12.7% YoY), commercial loans (+7.7%) and mortgages (+5.3% YoY).

President Claudia Sheinbaum presented a constitutional reform to gradually reduce workweek hours from 48 to 40 by 2030. The reform project considers that the first 2-hour reduction will be implemented from January 1st, 2027.

The Chamber of Deputies approved the appointment of César David Vives Flores as Hacienda’s Head of Public Credit and International Affairs. Mr. Vives previously was the Head of Public Debt.

With seven votes in favor and two against, the Supreme Court of Justice validated the 2% tax that the Mexico City government charges on digital delivery platforms for the use of urban infrastructure.

CETES auction: 27-day CETES +14 bps to 7.29%; 91-day CETES – 1 bps to 7.26%; 175-day CETES -2 bps to 7.44% and 693-day CETES flat at 7.85%.

Download PDF: MI-MxMktChatter-120525