MARKETS

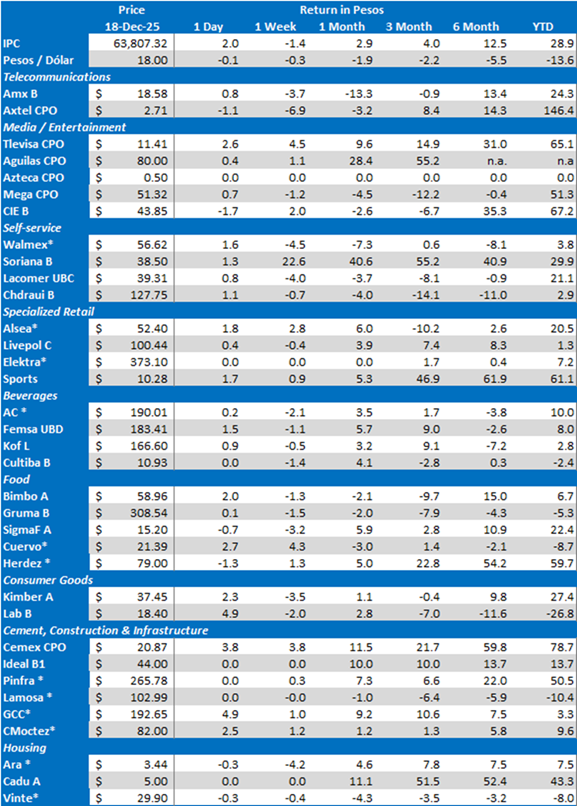

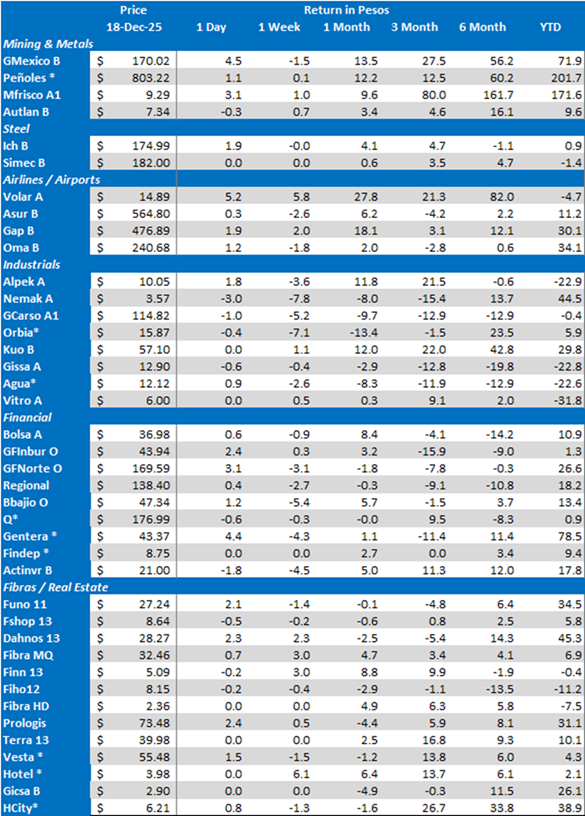

The S&P / BMV IPC was down 1.4% over the week, pressured by the correction in US equity markets due to concerns on high valuations of IA related stocks. Meanwhile, the Mexican peso gained 0.3% to close right at the psychological level of MXN$18.00/USD; and the yield of the 10-year M-Bono was down 3 bps to 9.08%.

The S&P / BMV IPC’s top gainers were: TLEVISA CPO (+4.5%), CUERVO * (+4.3%) and CEMEX CPO (+3.8%). On the other hand, the main losers were: ORBIA * (-7.1%), BBAJIO O (-5.4%) and GCARSO A1 (-5.2%).

LISTED COMPANIES

In a surprise development, Volaris and Viva announced an agreement to merge; shares surge. Both boards unanimously approved the deal, which now requires shareholders’ approvals and above all, anti-trust authorization given the deal will give the combined company dominant market share in the domestic airline industry. Should it go through, Viva’s shareholders would receive 50% of the combined company’s shares, which will remain listed on both the NYSE and the Mexican Stock Exchange. It would become the largest airline in Mexico. Shares soared nearly 20% at the open as the market cheered the news.

Citigroup obtained regulatory approval to sell a 25% equity stake in Grupo Financiero Banamex to Fernando Chico Pardo. He has now become the Chairman of the Board of Directors. Citi will move forward with its plans to sell its remaining stake through other private sales and an eventual IPO, potentially as early as next year, should market conditions allow.

Fibra Next announced that integration of the Jupiter Portfolio has been successfully completed. As part of NEXT’s strategic strengthening, the assignment of Fibra NEXT’s Right of First Refusal over E-Group assets was also formalized. This right grants NEXT the ability to access future growth opportunities and expand its presence in strategic markets. Likewise, NEXT reports that the consolidation of assets within Next Properties, the joint vehicle between NEXT and Funo, was successfully completed. This vehicle is comprised of: (i) 18 properties from the Jupiter Portfolio, contributed by NEXT at an approximate value of MXN$32 billion, together with bank debt of approximately MXN$4.1 billion, as well as net proceeds raised in the market; and (ii) 182 properties from Funo’s industrial portfolio, contributed by Funo at an approximate value of MXN$116 billion, together with bank debt and bond exchanges totaling approximately MXN$53 billion. Following the aforementioned transactions, the consolidated portfolio of Next Properties consists of 200 stabilized properties which, together with properties under development, represent approximately 7.6 million square meters of GLA. Additionally, Next Properties has a land bank of approximately 1 million square meters.

Grupo Aeroportuario del Centro Norte received approval from Mexico’s Ministry of Infrastructure, Communications and Transport (SICT), through the Federal Civil Aviation Agency, for the 2026–2030 Master Development Programs of all its concessionaires. The approved plans contemplate committed investments of MXN$16.005 billion, expressed in December 2024 pesos, aimed at strengthening OMA’s airport network through terminal expansion and modernization, development and rehabilitation of aeronautical infrastructure, and the incorporation of equipment and technology to enhance operational efficiency, installed capacity and passenger experience, in line with expected growth in passenger and cargo demand. In addition, the programs include investments in sustainability, energy efficiency and decarbonization initiatives, aligned with OMA’s long-term sustainability strategy to reduce environmental impact and promote more efficient and responsible airport operations. Analysts welcomed the terms of the new deal.

GFNorte has concluded the previously announced full acquisition of Rappicard after obtaining approval from the National Antitrust Commission. In April, GFNorte acquired a 44.28% equity stake that it did not own in the credit card unit for US$50 million. This transaction included a 15-year commercialization agreement.

Invex’s Investment Promotion division has signed an agreement to divest its remaining 20.0% stake in the Gana toll road project for MXN$3.96 billion (vs. a MXN$404 million book value), before closing adjustments, in exchange for FMX23 CBFEs. As a result, INVEX will increase its ownership in FMX23 to more than 20%, gaining significant influence. Aleatica will remain Gana’s controlling and operating shareholder with a 51% equity stake, while FMX23 will raise its equity stake in Gana from 29.0% to 49.0%. The transaction is expected to close in 1Q26 subject to customary regulatory approvals.

Fibra Prologis announced the sale of 440,000 square feet in Juarez to an existing customer for US$19.8 million. These properties were previously part of the Terrafina portfolio and were subject to contractual purchase obligations under the lease.

Fibra Upsite announced its first capital reimbursement of US$55.9 million, equivalent to US$1.10/CBFI, in two equal installments of US$27.95 million (US$0.55/CBFI), the first one on December 29th, and the second one on April 30th, 2026. The dividend yield is 53.5% against the most recent CBFI price of MXN$36.99 (US$2.055).

Axtel obtained a 10-year MXN$1.6 billion loan from Bancomext. The telecommunications company used proceeds to prepay US$60 million of its IFC loan and partially prepay US$28 million of a syndicated bank loan. As a result, Axtel extended the average maturity of its total debt from approximately 3 to 4 years, strengthening the capital structure.

Sigma Foods announced the launching of its new logo, its new website and its new ticker symbol “SIGMAF A” from December 17th, 2025.

Grupo La Comer announced the opening of its first City Market store in the state of Baja California Sur, through a MXN$732 million investment. The store generates 443 formal jobs, of which 312 are direct and 131 indirect. With this opening, the company now operates 92 commercial units nationwide.

OTHER COMPANIES

Acciona Energía announced the sale of selected assets in Mexico and the US to Mexico Infrastructure Partners (MIP) in a US$1.0 billion transaction. The deal includes a 49% stake in a 1.3 GW U.S. solar portfolio and the full divestment of two wind farms in Tamaulipas, Mexico, with a combined capacity of 321 MW. Closing is expected in 1H26 subject to regulatory approvals and financing conditions.

The CFE will invest US$4.3 billion in the construction of four combined-cycle power plants located in Tula, Hidalgo; Salamanca, Guanajuato; Altamira, Tamaulipas; and Mazatlán, Sinaloa. These projects are currently in the engineering phase and construction is expected to begin soon. The fifth project is an internal combustion power plant in Los Cabos, Baja California Sur, with a capacity of 240 megawatts.

Fintech Plata announced it has raised US$500 million in a financing deal arranged by Nomura Securities International. Last October, the Fintech closed a US$250 million equity round led by Kora Management, which translated into a US$3.1 billion valuation.

Spain’s BBVA announced a strategic partnership with OpenAI aimed at transforming customer-facing financial services through advanced artificial intelligence. The collaboration seeks to develop an intelligent conversational assistant to support customers in their daily financial decisions and to create additional AI-driven tools that allow relationship managers to deliver fully personalized service.

Empresas ICA was awarded a MXN$1.72 billion (US$95.4 million) contract to build a high-capacity trolleybus corridor in Ixtapaluca, State of Mexico, according to El Economista. The project will connect Ixtapaluca with Line 11 of the Chalco–Santa Marta trolleybus system, strengthening public transport infrastructure in the eastern part of the State of Mexico.

Jüsto closed its operations in Mexico on December 15th 2025, citing financial, operational and strategic pressures in a highly competitive digital retail environment, ending six years of online grocery service.

Mercado Libre opened a new US$5 million distribution center in Hermosillo, Sonora, bringing its total number of logistics centers in Mexico to 14 as part of its strategy to strengthen its national logistics network. The Hermosillo facility, the first in the State of Sonora, will enable same-day deliveries in the cities of Hermosillo, Nogales, and Ciudad Obregón.

ECONOMIC

Banco de Mexico cut its key interest rate by 25 bps to 7.0% as widely expect by the latest Citi Mexico Expectations Survey. The decision was divided with 4 members voting for a 25-bps interest rate reduction and hawkish deputy governor Jonathan Heath voting to leave it unchanged. Banxico’s 2025 inflation forecasts were revised upwards for the next 3 quarters, but its estimates for the end of 2026 remained unchanged at 3.0% (headline and core).

ANTAD reported that same store sales rose 4.2% YoY in November 2025, with self-service increasing 2.5%, department stores 5.0% and specialized retail 5.5%. Total sales advanced 6.5% YoY, supported by growth of 4.9% in self-service, 6.4% in department stores and 9.2% in specialized retail.

Industrial activity increased by 0.7% MoM (seasonally adjusted) in October 2025, with gains in construction (+3.8%), utilities (energy/water/gas +1.6%) and mining (+0.7%) more than offsetting a decline in manufacturing (-0.3%), INEGI reported. Industrial activity fell 0.7% YoY (original data), driven by contractions in manufacturing (-1.3%) and mining (-0.7%), while construction (+2.5%) and utilities (+1.9%) provided modest upward support.

Retail sales grew 0.4% MoM (seasonally adjusted) in October, INEGI reported. As a result, retail sales advanced 3.4% YoY (original data).

Service sector’s total revenues increased 0.2% MoM (seasonally adjusted) in October, the second consecutive month with a positive monthly figure, according to INEGI. They increased 0.6% YoY (original data).

Total sales during the “El Buen Fin” discount campaign were up 26.6% YoY to MXN$219.2 billion, according to the Economy Ministry. This included a 31% YoY increase in on-line sales to MXN$45.7 billion, according to the Mexican Association of On-line Sales (“AMVO”). They represented 21% of total “El Buen Fin sales.

Economists continue to expect a 25-bps interest rate cut at Banco de Mexico’s next monetary policy meeting, unchanged from the prior survey, according to the December 17th Citi Mexico Expectations Survey. The median policy rate forecast remained at 7.00% for YE25, and 6.50% for YE26. GDP growth expectations stayed at 0.4% for 2025, while the 2026 forecast declined marginally to 1.2%, from 1.3%. YE25 headline inflation projection increased to 3.90%, from 3.79%, and core inflation rose, to 4.40% from 4.23%; the YE26 headline inflation edged down to 3.90%, from 3.95%, and core inflation increased to 4.00%, from 3.89%. Peso projections improved, with the USDMXN forecast for YE25 strengthening to 18.37, from 18.51, and for YE26 to 19.00, from 19.20, in the previous survey.

Afores’ AUM’s increased 20.8% YoY to MXN$8.27 trillion pesos in November 2025, according to CONSAR’s data. The system’s investments included 52% in government debt, 7% in domestic equities, 13% in international equities, 1% in commodities, 12% in domestic private debt, 8% in structured instruments, 3% in Fibras, 0.6% in foreign debt and 3% in other investments.

The Energy Ministry approved 20 privately sponsored renewable energy projects representing a combined investment of US$4.752 billion. Under the new binding planning framework, permitting timelines were reduced from up to 18 months to an average of two months. The projects comprise 3,320 MW of generation capacity and 1,488 MW of storage capacity, with phased commissioning between 2026 and 2029. They will be developed across 11 states—Campeche, Hidalgo, Yucatán, Guanajuato, Oaxaca, Tamaulipas, Quintana Roo, Puebla, Veracruz, Zacatecas, and Querétaro—and include 15 photovoltaic projects and five wind projects.

Mexico’s decision to increase tariffs on more than 1,400 imported products from countries with no free trade agreements, primarily in Asia, was positively received by the United States government, which described the move as a constructive factor ahead of the 2026 USMCA review. This assessment was outlined by US Trade Representative Jamieson Greer in his report to the US Congress.

Mexico and the United States reached an agreement under the bilateral water treaty. Mexico thus avoided the 5% tariff that US President Donald Trump had threatened to apply.

India proposed a preferential trade agreement with Mexico to mitigate the impact of tariffs ranging from 5% to 50% on products imported from countries with no free trade agreement, according to Reuters. India’s Trade Minister Rajesh Agrawal said discussions are already underway following a meeting with Mexico’s Deputy Economy Minister Luis Rosendo Gutiérrez.

CETES auction: 28-day CETES -10 bps to 7.15%; 91-day CETES +5 bps to 7.25%; 175-day CETES -5 bps to 7.50% and 679-day CETES +19 bps to 8.04%.

Download PDF: MI-MxMktChatter-121925