MARKETS

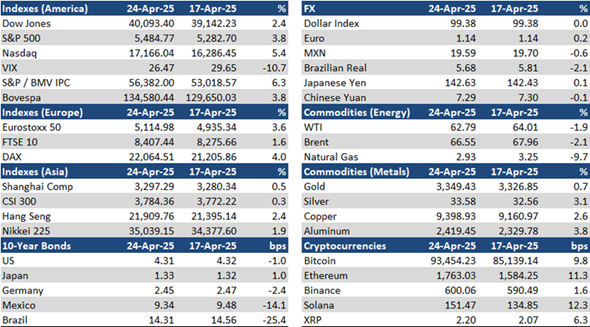

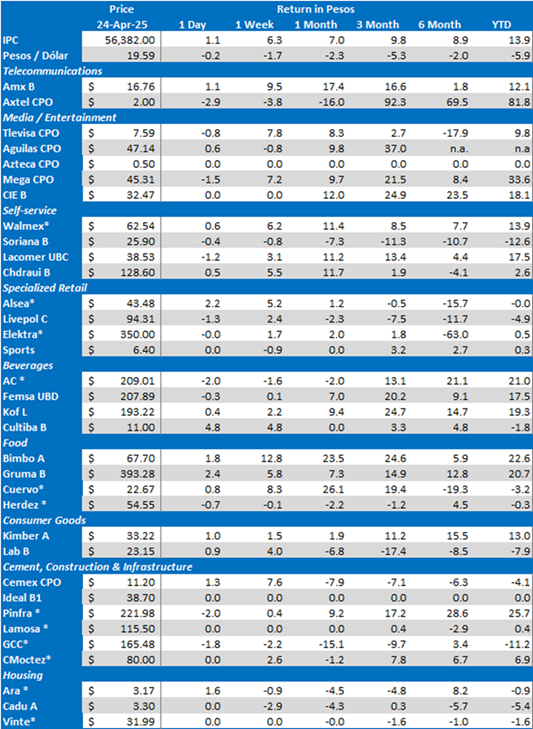

The S&P / BMV IPC rallied 6.3% over the week, amid general global market optimism regarding the potential of easing tariffs, further boosted by mostly strong quarterly reports. Meanwhile, the Mexican peso appreciated 0.6% and the yield of the 10-year M-Bono declined 14 bps to 9.34%.

The S&P / BMV IPC’s top gainers for the week were rose by double-digits: ALFA A (+18.5%), Q* (+14.5%) and GENTERA * (+13.1%). On the other hand, the main losers were: GCC * (-2.2%) and AC * (-1.6%).

LISTED COMPANIES

Alfa (now Sigma) stock rallied as it reported soft but better than expected 1Q25 results with total revenues declining 5% YoY in USD terms caused by unfavorable currency conversion effects from the depreciation of the Mexican peso and euro. Volume was slightly lower, while local currency prices increased in both Mexico and Latam. Comparable EBITDA excluding extraordinary items fell 14% YoY, reflecting the peso depreciation, cost pressures from higher raw material prices and temporary disruption from the Torrente plant flooding in Spain. The EBITDA margin narrowed to 10.5% from 12.2%. Net profit increased 197% YoY, supported by lower financial expenses and a higher gain from discontinued operations. .

Qualitas delivered positive 1Q25 results. Written premiums increased 12.0% YoY, supported by growth in the traditional and individual segments. Earned premiums were up 17.8%, reflecting a favorable mix and lower reserve buildup. Insured units rose 6.6% to nearly 5.9 million, driven by stable new vehicle sales and solid retention. The combined ratio fell 123 bps to 88.2% mainly due to a 433 bps reduction in the loss ratio due to lower claim frequency and seasonality. Comprehensive financial income rose 44.8%, fueled by strong fixed income returns and a favorable rate environment. Net profit jumped 73.3% to MXN$2.145 billion, one of the strongest quarters in the company’s history.

Gentera posted very strong 1Q25 results. The loan portfolio rose 26.3% YoY, driven by solid growth in its Mexican and Peruvian subsidiaries. The NPL ratio increased slightly to 3.73% from 3.57%. Net interest income advanced 24.3% supported by higher lending activity. NIM remained stable at 39.5%, while NIM after provisions declined to 29.3% from 30.3%, impacted by a 37.6% increase in provisions due to strong portfolio growth. Adjusted financial margin after provisions rose 20.3%, showing resilience despite greater provisioning. Operating expenses were up 20.1%, explained by the expansion of loan officer teams and strategic investments. Net income increased 47.3% YoY to a record level of MXN$2.2 billion, while ROE climbed to 25.8%, from 21.1%.

GCC reported weak 1Q25 results. Consolidated revenues were down 9.6% YoY due to weaker cement and concrete volumes in Mexico and lower cement demand in the US, partially offset by stronger US concrete sales and higher prices in both markets. Cement volumes declined 4.3% in the US and 12.4% in Mexico, while concrete volumes rose 4.7% in the US and fell 12.7% in Mexico. Cement prices advanced 3.0% in the US and 5.2% in Mexico, while concrete prices rose 12.1% and 2.9%, respectively. EBITDA was 11.3% below the prior year, reflecting a decline in operating leverage, with the EBITDA margin narrowing to 29.8% from 30.4%. Net profits dropped 16.9% YoY. The company announced it has secured two bank loans amounting to US$135 million to support the expansion of its cement plant in Odessa, Texas, its main market. The company also completed a US$100 million acquisition of three aggregate operations in Texas, boosting production capacity and strengthening its footprint in key cities.

Arca Continental posted 1Q25 results below consensus. Sales were up 12.4% YoY, reflecting strong pricing strategies, solid execution across markets, particularly in the US and Argentina, and the FX benefit. However, total volume fell 3.1%, affected by lower demand in Mexico and the US, partially offset by a strong recovery in Argentina and resilience in still beverages. Gross profit advanced 11.9%, although the gross margin declined slightly by 20 basis points to 46.3%, due to cost pressures tied to FX impacts and marketing expenses. EBITDA increased 10.2%, while the EBITDA margin contracted 30 basis points to 18.7%, influenced by higher marketing and maintenance expenses. Net income rose 10.2%.

GFNorte reported positive 1Q25 results; all options on the table for Bineo. The loan portfolio expanded 13% YoY, driven by double-digit growth across consumer, corporate, and commercial segments, while the non-performing loan ratio remained stable at 0.9% due to disciplined origination. The net interest margin held steady at 6.3%, as portfolio growth and improved funding costs offset lower reference rates. Provisions increased 12%, reflecting higher credit origination, especially in consumer lending. Operating expenses grew 11%, attributed to business expansion and technology investments, with an efficiency ratio of 34.6%, from 34.0% a year earlier. Net profit climbed 8%, fueled by higher interest income and strong insurance and brokerage performance. ROE was up 140 bps to 23.4%. The company announced it is analyzing the sale or merger of its Bineo digital bank, among various options.

Gruma delivered mixed 1Q25 results with lower revenues but significant margin expansion. Gruma’s revenues declined 6% YoY in USD terms, mainly due to currency translation effects from a weaker Mexican peso, lower volumes in the US food service segment and lower sales at GIMSA. Consolidated volume fell 1% reflecting price sensitivity in the US food service channel and softer demand at GIMSA and in Europe. Gross profit remained flat, but the gross margin expanded by 250 basis points to 39.8%. EBITDA rose 4%, driven by improvements in the U.S. and Europe, with the EBITDA margin increasing to 17.8%, from 16.0%. Net profits were up 13%, helped by lower financial costs.

Alpek reported weak 1Q15 results with revenues falling 10% YoY in USD terms due to lower volumes and weaker global pricing conditions. Comparable EBITDA was down 18% YoY, as persistent oversupply and compressed margins in the Polyester segment weighed on results. The EBITDA margin also narrowed, reflecting the pricing pressure and input cost dynamics in international markets. Net profits were flat. Alpek is actively reviewing its 2025 outlook. The guidance it shared earlier this year did not reflect potential impacts from evolving tariff dynamics or shifts in demand.

Kimberly-Clark de México reported weak 1Q25 results. Sales were essentially flat compared to 1Q24, due to a slower consumption environment with Consumer and Away from Home segments declining 1% and 4%, respectively, which was partially mitigated by a 21% export growth. Gross profit was down 9% YoY, mainly due to a significantly weaker peso and unfavorable comparisons in virgin fibers and fluff costs, despite favorable prices for SAM and resins and stable recycled fiber costs. The gross margin stood at 38.2%. EBITDA fell 11% YoY, with a margin of 25.1%, as the company absorbed higher raw material prices and currency headwinds but benefited from MXN$450 million in cost savings from its reduction program. Net income declined 12%, with operating weakness partially offset by lower financings costs.

Asur reported 1Q25 results below expectations. Revenues advanced 18.2% YoY boosted by strong growth in Puerto Rico and Colombia and a rebound in commercial revenues. Passenger traffic increased 0.2%, as a 10.6% surge in San Juan and a 6.4% gain in Colombia offset a 4.8% drop in Mexico. EBITDA rose 11.7% YoY, while the EBITDA margin narrowed to 65.1%, from 68.9%, affected by higher costs across regions. Net profits were 14.2% higher.

Bolsa posted positive 1Q25 results. Revenues increased 17% YoY, fueled by higher transactional activity, increased custody and conversion of international securities, and a favorable FX effect on dollar-based services. EBITDA rose 17%, and the EBITDA margin saw a 29 bps uptick to 57.4%. Net profits rose 16% YoY.

Herdez reported strong 1Q25 results. Sales increased 9.3% YoY, supported by a 10.3% rise the Preserves segment which benefitted from a higher demand in wholesale and foodservice channels. Volume advanced 4.8%, reflecting broad-based demand recovery. Gross profit climbed 13.0%, with the gross margin expanding 1.3 percentage points to 40.7%, driven by a stronger product mix in Preserves, a favorable FX effect and lower raw material costs in exports. EBITDA grew 13.0%, with the EBITDA margin rising to 18.2% from 17.6%, Net income was 20.1% higher, helped by higher equity income from MegaMex.

Nemak reported mixed 1Q25 results, with weak volumes but resilient profitability. Revenues remained mostly flat, as the impact of lower volumes was offset by favorable pricing adjustments and higher aluminum costs. Volume fell 7.3%, reflecting weaker vehicle production in Europe and North America. EBITDA increased 2.9%, supported by operating efficiencies, better commercial terms, and FX gains. The EBITDA margin held steady at 12%, with per-unit profitability improving 10.9%. The company reported a net loss of US$16 million, mainly due to non-cash FX losses.

Grupo Rotoplas’ reported 1Q25 results that slightly exceeded market expectations. Sales decreased 1.2% YoY, primarily due to a 9.7% drop in Mexico’s revenues, which faced a high comparison base due to last year’s drought. This was partially offset by strong performance in other countries (Argentina +2.0%, US +24.9%, and other countries +23.1%). Gross profit fell 17.4% YoY due to higher sales cost resulting from the FX depreciation and lower fixed cost absorption in Mexico and Argentina, which generated an 830 bps contraction in the gross margin to 42.4%. EBITDA decreased 45.9% YoY. Net income plunged 92.3% YoY due to higher financial expenses.

Vinte delivered positive 1Q25 results. Revenues increased 7.7% YoY on a proforma basis as the company continued to benefit from its integration with Javer and its focus on middle-range and residential housing, resulting in a 7.3% increase in the average price per unit. Additionally, volume grew 1.1% to 3,419 units. Vinte generated synergies with Javer in material costs purchases and made progress in technological standardization and alignment of operational processes. This allowed the EBITDA margin to expand 30 bps to 16.0%, boosting the combined EBITDA by 9.8% YoY to MXN$522.9 million. Net profits rose 26.9% YoY thanks to the favorable operating performance combined with lower financial expenses.

Femsa’s Oxxo chain signed an agreement with Banco Actinver to enable cash withdrawals at more than 23,000 stores across Mexico. Actinver customers can withdraw up to MXN$3,000 per transaction, with a MXN$20 fee charged to their debit cards.

Alsea announced a development agreement with Chipotle Mexican Grill to introduce the brand in Mexico. The first restaurant will likely be launched by early 2026, and the companies intend to assess further regional opportunities.

OTHER COMPANIES

Nu México, the local unit of Brazilian digital bank Nubank, received initial approval from the CNBV to operate as a multiple banking institution in Mexico, becoming the first Sofipo to receive such license. The request, filed in October 2023, aims to expand services into payroll, SME lending, and investment products. A final operational green light is expected to take about 180 days. Nu México has more than 10 million customers.

WWE announced the acquisition of Mexican wrestling company AAA in partnership with Mexico-based fund Fillip. The Peña family, founders of AAA, will remain involved alongside WWE and Fillip in the company’s next stage.

TRADE AND ECONOMICS

The inflation rate was 0.12% in the first half of April, INEGI reported, which compares against the 0.03% expectation according to the latest Citi Mexico Survey. The core inflation rate was 0.34%, above the 0.23% consensus forecast. This translated into a twelve-month inflation rate of 3.96% YoY (vs. 3.77% E) and a core inflation rate of 3.90% YoY (vs. 3.79% E).

Fitch affirmed Mexico’s long-term foreign currency rating at ‘BBB-’ with Stable Outlook. Mexico’s rating is supported by a prudent macroeconomic policy framework, robust external finances, and its large and diversified economy. The rating is constrained by muted long-term growth, weak governance indicators, fiscal challenges related to a low revenue base and budgetary rigidities, and contingent liabilities from Pemex. The Stable Outlook reflects Fitch’s view that Mexico’s rating has headroom to withstand the tougher economic environment implicit in our new baseline. An economic slowdown already underway is likely to worsen amid an aggressive turn toward trade protectionism in the US under the Trump administration. However, Fitch expects these developments will reinforce the muted growth already captured in the rating but not worsen it in a major and lasting manner. It expects the administration of President Sheinbaum will keep its fiscal consolidation goals broadly on track despite this difficult backdrop.

Economists continue to expect a 50-bps reduction in Banco de Mexico’s May monetary policy meeting, according to the lastest Citi Mexico Expectations Survey. The year-end 2025 interest rate forecast was revised down to 7.75%, from 8.00%, while the 2026 projection remained at 7.00%. GDP growth estimates declined to 0.2% for 2025 (from 0.3%) and held steady at 1.5% for 2026. Headline inflation expectations stayed at 3.78% for 2025 and rose to 3.79% for 2026, while core inflation projections increased to 3.80% (from 3.76%) in 2025 and remained at 3.70% for 2026. The peso is now forecast to end at 20.93 per USD (up from 20.90) in 2025 and 21.20 (down from 21.30) in 2026.

ANTAD’s same-store sales rose 1.0% YoY (self-service +2.6%, department stores -1.7% and specialized retail +1.7) in nominal terms in March, while total sales grew 3.7% (self-service +5.7%, department stores -0.4% and specialized retail +5.5%).

The IMF has lowered its GDP forecast for Mexico to -0.3% for 2025 and 1.4% for 2026 (vs. previous estimates of 1.4% and 2.0%, respectively) as a result of tariffs announced through April 2nd, the country’s initial response, and certain assumptions about the evolution of trade policy.

CETES auction: 28-day CETES -20 bps to 8.80%; 91-day CETES –3 bps to 8.63%; 175-day CETES -10 bps to 8.43% and 693-day CETES -5 bps to 8.70%.

Download PDF: MI-MxMktChatter-042525